GlobalData expects that an average capex of $18.2bn per year will be spent on 382 oil and gas fields in Brazil between 2018 and 2020. Capital expenditure into Brazilian traditional oil projects will add up to $47.2bn over the three-year period, while heavy oil fields will require $6.2bn over the same period. Investments into gas projects in Brazil will total $1.1bn in upstream capital expenditure by 2020.

Ultra-deepwater projects will be responsible for over 82% of $54.5bn of upstream capital expenditure in Brazil, or $44.7bn by 2020. Brazil’s deepwater projects will necessitate $5.1bn in capital expenditure over the period. The country’s shallow water and onshore projects will require a capex of $3.4bn and $1.3bn, respectively.

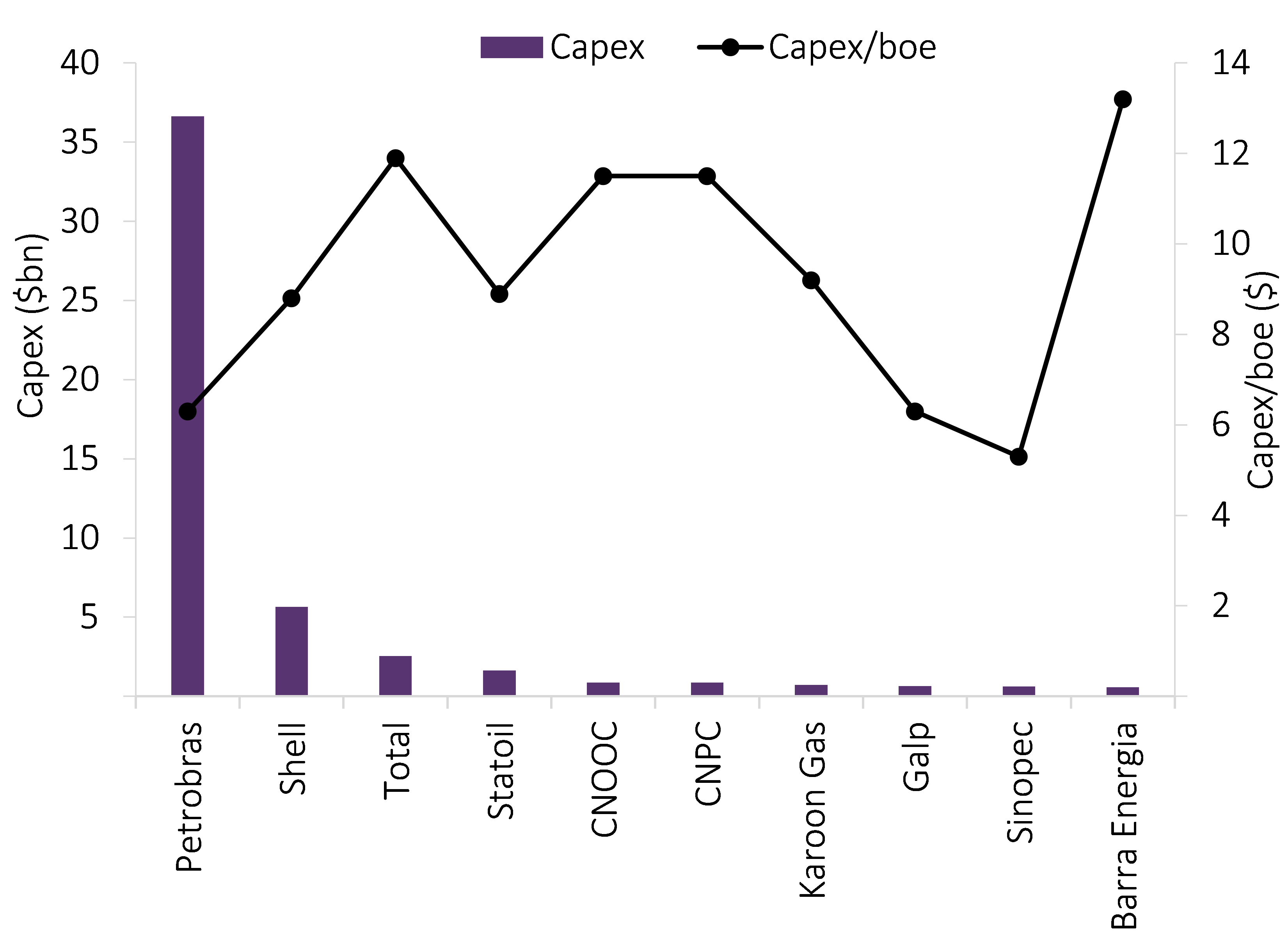

GlobalData expects that Petroleo Brasileiro (Petrobras) will lead the country in capital expenditure, investing $36.6bn into upstream projects in Brazil by 2020. Royal Dutch Shell and Total will follow with $5.7bn and $2.6bn, respectively, invested into Brazilian projects over the period.

Capital expenditure by Brazil’s major companies

Source: GlobalData Upstream Analytics

The producing, ultra-deepwater Libra field will lead capital investment with $4.8bn to be spent between 2018 and 2020, followed by planned ultra-deep field Lula Oeste with a capex of $4.1bn, and another planned ultra-deep field, Buzios V (Franco), with a capex of $3.4bn. Petrobras is the operator for all the above fields.

GlobalData reports the average remaining capital expenditure per barrel of oil equivalent (capex/boe) for Brazilian projects at $8. Shallow water projects have the lowest remaining capex/boe at $7, followed by onshore, ultra-deepwater and deepwater developments with $7.2, $10.6 and $12.3 respectively.