The shale boom around 2010 prompted both multinational oil companies and independents to invest significant capital in exploring vast areas across the US Lower 48 (L48).

As the productive regions of major shale plays became more defined over time, companies increasingly turned to deal-making as a strategy to replace declining reserves and ensure their long-term viability in this competitive oil and gas sector. Following the recovery in oil demand post-pandemic, mergers and acquisitions (M&A) activity surged within the North American oil and gas industry, including in US shale. According to GlobalData, the region recorded more than 600 deals in 2023, totalling approximately $300 billion in value. Notably, the US L48 shale plays accounted for nearly 60% of this deal value, largely driven by ExxonMobil’s acquisition of Pioneer Natural Resources for $64.5 billion.

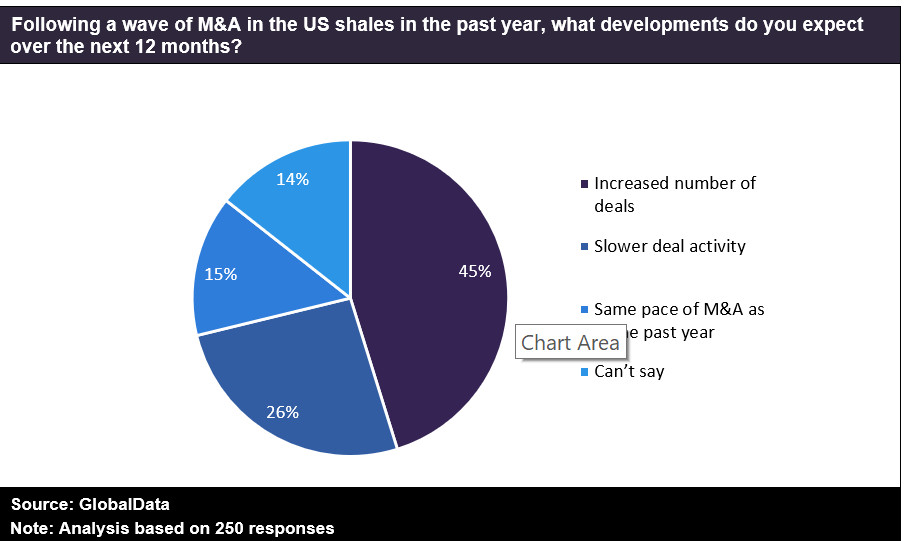

In light of this recent consolidation, GlobalData conducted a poll among its readers to assess the short-term outlook for deal-making in US shales. The poll, carried out from September to October 2024, received 250 responses. Approximately 45% of respondents believed there could be further consolidation in the US upstream sector, particularly in the shale regions.

This perspective may stem from the fact that many shale drillers accumulated significant debt during the pandemic, making them potential targets for acquisitions. Incidentally, the oil and gas industry generated substantial cash flows in 2022 and 2023 due to a spike in commodity prices amid supply chain disruptions caused by the Ukraine conflict. This financial boost has allowed companies to pursue M&A activities to realign their acreage positions across various plays, especially in the Permian Basin, which continues to yield promising returns for investors.

Approximately a quarter of respondents expressed the view that deal activity in the US L48 may decrease in the short term. This belief could stem from the perception that most potential acquisition targets have already been secured, leading to a limited pool of companies available for M&A. Additionally, some respondents may be questioning the feasibility of future high-value deals due to the significant rise in valuations among publicly listed shale drillers over the past two years. Besides, the long-term outlook of the oil and gas industry remains uncertain amid calls for switching to clean energy sources to mitigate climate change concerns. Notably, GlobalData’s analysis indicates that North American deal activity, by volume, declined in the first half of 2024.

Around 15% of the respondents to this poll indicated that deal activity in US shales would continue at the same pace as before. These respondents seem to have opted for a more balanced view, considering both the driving factors and potential pitfalls in undertaking future deals in the current macroeconomic environment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData