Following the recent surge in JKM natural gas price, the US has benefitted from the increased premiums on LNG shipments but now need to focus on playing its role to supply for the future growth of LNG.

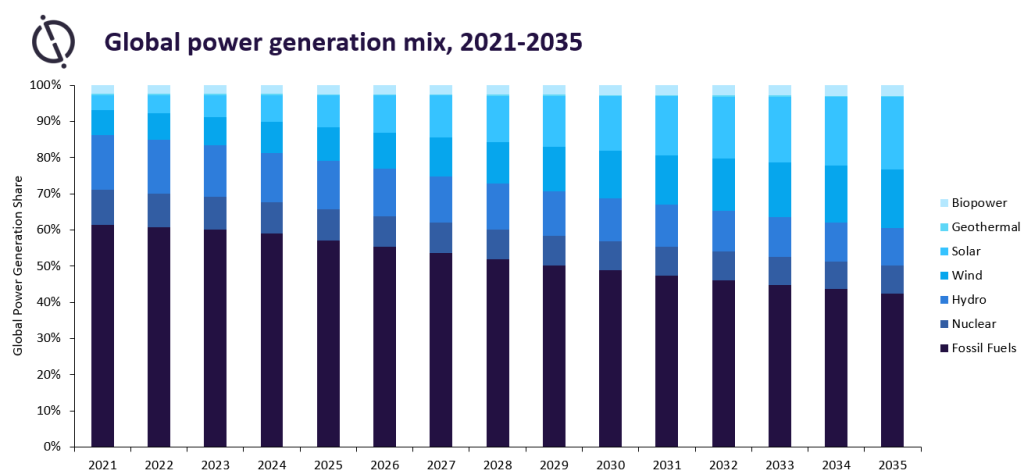

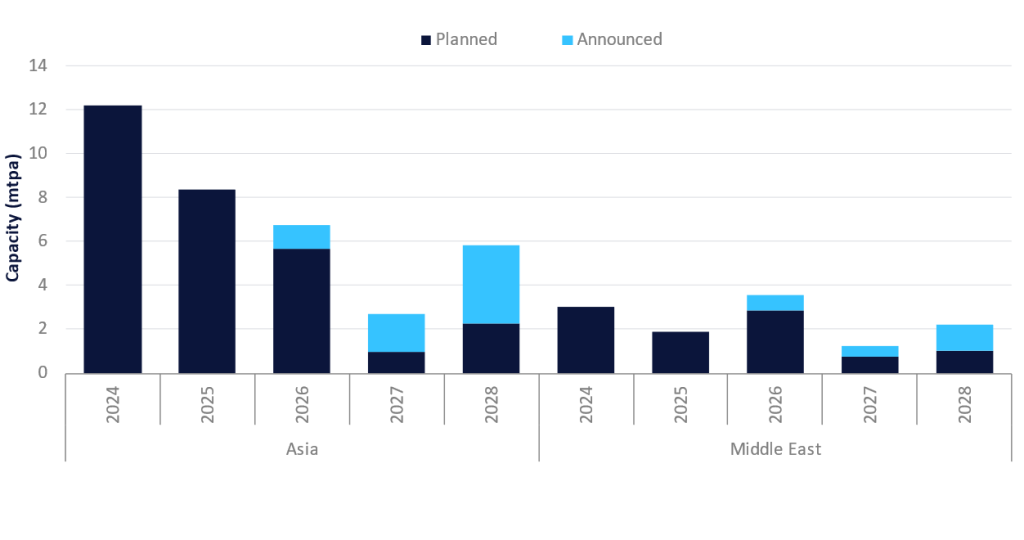

Natural gas demand has been growing at a substantial rate prior to the pandemic at an average of 2%-4%, however, expected to slow down in the next five years up to 2025 averaging around 1.3% growth. Looking ahead into 2025, US LNG exports will have an increasing role to play to supply for the growth in demand driven primarily from an average growth rate of 3.33% annually in Asia. This is led by China and India, with both countries potentially adding up to 65Mtpa and 25Mtpa respectively of LNG regasification capacity by 2025.

The recent rally in natural gas prices occurred due to a series of supply glitches and strong winter buying demand from Asian buyers, increased to as high as $20 per million cubic feet (mcf). On the supply side, Malaysia could not meet the production and delayed LNG delivery to Japan. The situation was worsened due to the cargo constraint, and the tightening of shipping market, sending JKM prices to soar to record high. US LNG exports have benefited greatly from the increased premium differentials and the desperate call for LNG imports, landing up to 14 cargoes exported to China alone in the month of January compared to none a year ago. However, there has been a few reported cancellations of cargoes in January and as many as ten cargoes expected in February, mainly due to lack of shipping availability and aggressively high shipping rates. The main beneficiaries from the surge in LNG trades are international companies with multiple access to natural gas resources such as Royal Dutch Shell and Total SA. These companies were able to repurpose and re-route some of their tankers that were destined for Europe to meet Asia demand for far greater profits while replacing the gas in the European market with the purchase of pipelined gas, which is easily offset by the substantial premium in Asia LNG market.

US natural gas export volume declined dramatically during the summer months, recording as low as 3.1 billion cubic feet per day (bcfd) in July 2020. However, the natural gas export volume has recovered dramatically surpassing the export volume in January 2020, setting a record in November 2020 of 9.35 bcfd, and standing at 92% of peak LNG export capacity utilisation. Despite the surge in JKM prices in early 2021, many of the LNG exporters were not able to find sufficient volume quickly enough to meet the demand in Asia region due the high utilisation of LNG export capacity.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

There is currently 10.14bcfd of active after the recent expansion of Sabine Pass Project by Cheniere Energy. There are at least 10bcfd of new capacity planned not yet under construction also expected to come online by year 2025, which will have a huge impact on the role of US as a LNG provider to fill the growth in demand. However, with these projects delays or postponements are more likely due to the current uncertainty on the pace of recovery.

Related Company Profiles

Shell plc

Cheniere Energy Inc

TotalEnergies SE