After resuming office for the second time, US President Donald Trump issued several executive orders to support the country’s oil and gas industry. One of the primary goals of Trump’s energy policy is to achieve energy independence for the US.

Through a combination of increased domestic production and reduced reliance on foreign crude oil imports, his administration has sought to bolster energy security and reduce trade imbalance.

He has eased several environmental regulations, including those related to methane emissions and oil drilling in offshore waters. He has also proposed expanding offshore drilling in previously restricted areas, including the Atlantic and Arctic oceans to tap into untapped oil reserves and further boost domestic production.

These changes are intended to ease compliance burdens on oil and gas operators and stimulate growth in the industry.

Considering this strong push for hydrocarbon production, leading data and analytics company GlobalData conducted a survey among its readers to understand their views on the likely impact of President Trump’s executive orders on the crude oil and natural gas production outlook in the US.

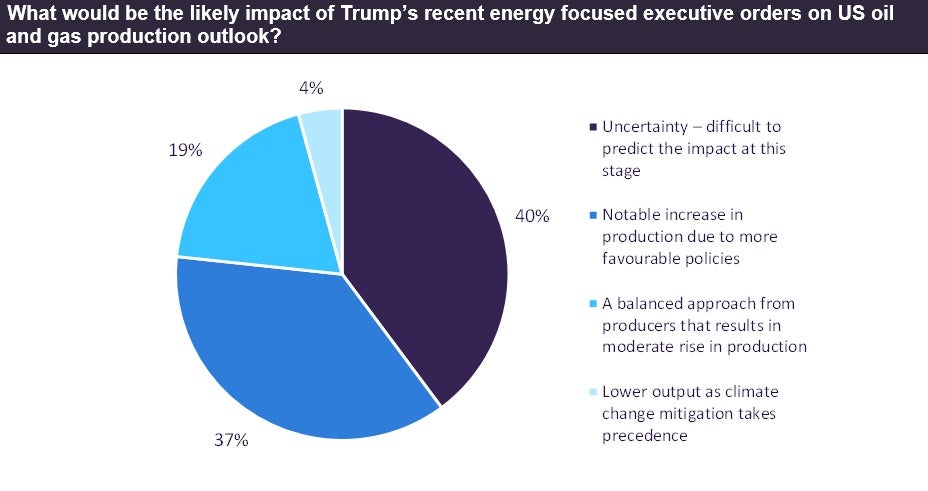

The poll was carried out in February and March 2025 and received 236 responses over this timeframe. Around 40% of the respondents expressed uncertainty over the impact of these executive orders at this stage. This might be because these orders were issued only a month ago and further directions might be made available in due course to present an opinion.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPerhaps, the next few quarterly filings and investor presentations from top producers in the US might give better insight into the future trend.

The US is already producing crude oil and natural gas at record levels through its prolific shale patches in the Lower 48 region. Any notable increase in production levels might require companies to deviate from their current strategy of observing capital discipline.

A slightly lesser share of around 37% of respondents opined that the US might see a considerable increase in its oil and gas production due to the adoption of these policies.

This is largely in line with President Trump’s policy of increasing domestic production to reduce energy costs and inflation while lowering its reliance on imports. Besides costs and pipeline capacity limitations, crude oil production in some states within the US is often withheld due to emission regulations and gas flaring mandates.

Additionally, drilling is prohibited across certain federal lands and water bodies due to its probable impact on the sensitive ecosystems thriving in those areas. Opening up such locations might allow for the discovery of new hydrocarbon reserves, but at the expense of the environment.

Nearly 20% of the respondents expected oil and gas drillers to adopt a balanced approach to production. This would mean adjusting the supplies as per the demand fluctuations in the market to ensure stable revenues for companies.

There is also the concern of a likely slowdown in the US economy due to the country’s tariff policies that might weigh on its trade, and hence energy consumption. In this scenario, a balanced approach to oil and gas production might be more beneficial in the short term.

Lastly, 4% of the respondents anticipated a decline in the US crude oil and natural gas output to combat climate change. Although this scenario might hold true in the long term, until then the country’s hydrocarbon output is likely to rise or at least remain flat.

It is important to note that upon resuming the presidency of the US in 2025, Trump withdrew the nation from the Paris Agreement, effectively halting all American involvement in international climate agreements.