Nigeria’s oil and gas sector is at a pivotal moment as it navigates through a complex regulatory landscape and fiscal reforms introduced by the Petroleum Industry Act (PIA) of 2021.

The latest reports on Nigerian Oil and Gas, the ‘Nigeria Upstream Fiscal and Regulatory Guide‘, and the ‘Nigeria Exploration and Production Report‘, by GlobalData, provide a comprehensive overview of these changes and the implications for stakeholders in the industry, and the general supply outlook for oil and gas in the country.

Regulatory and fiscal overhaul

The PIA, enacted in August 2021, aimed to revitalise Nigeria’s oil and gas sector, which is critical to the economy, contributing over 85% of export earnings and approximately 30% of budget revenues. This landmark legislation restructures fiscal terms, institutional frameworks, and regulatory policies to attract investment and boost efficiency.

Key changes in fiscal terms

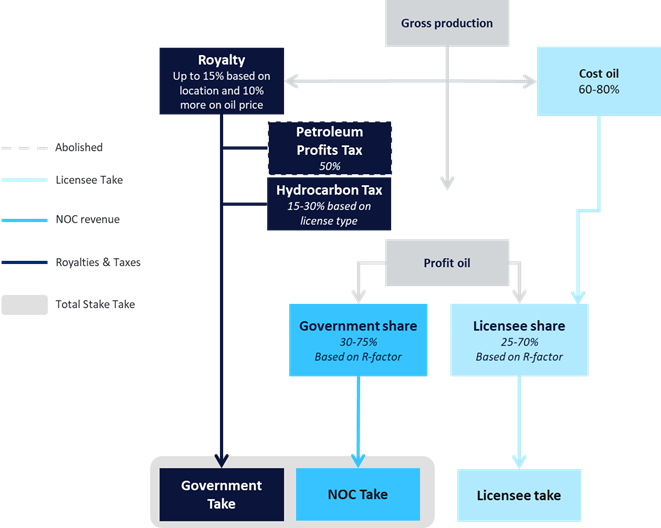

One of the significant changes introduced by the PIA is the restructuring of royalty rates. Previously, royalties ranged from 7.5% to 20%, depending on factors such as terrain, exploration maturity, and oil prices. The new regime simplifies this to a range of 5% to 15%, with an additional 0% to 10% royalty based on oil prices. For gas and natural gas liquids, the rates are lower, reflecting the PIA’s goal to stimulate investment in these areas. Moreover, while maximum royalty rates are higher, price-based royalties start at higher prices, and the production-based royalty ladder allows small fields to pay lower royalties.

The PIA also replaces the Petroleum Profits Tax with a Hydrocarbon Tax (HT), set at 30% for onshore and shallow water fields, while deepwater operations are exempt. This change is designed to make deepwater projects more financially viable and attractive to investors. Additionally, the act introduces a Production Allowance tied to water depth, replacing the former Investment Tax Allowance, and maintains other taxes such as the Education Tax and the Niger Delta Development Commission Levy, though with minor adjustments.

Nigeria, profit sharing agreement regime flow chart

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Impact on business operations

The report highlights how these changes impact business operations. For instance, the cost recovery limit under production sharing agreements (PSAs) is now capped at 70% for new licenses and 60% for converted licences, down from a potential 80% previously. This is expected to tighten profit margins but also encourage more disciplined cost management among operators.

According to GlobalData’s economic modelling, the state take under PSAs is notably high, often making these projects less attractive compared to joint ventures (JVs) and concession agreements. Some PSAs now face an increased state take share due to the new fiscal terms, which include a higher Hydrocarbon Tax and adjusted royalty rates.

For instance, under the PIA, the indicative discounted state take for oil projects is approximately 81%, and for gas projects, it is around 77%. This high state take can limit the profitability of certain projects, particularly those with high capital and operating expenditures. The report suggests that while gas projects tend to have higher profitability due to lower royalty rates, PSAs can generally yield lower returns compared to JVs or sole-risk operations.

The guide indicates that while the PIA has made strides in creating a more structured and predictable fiscal environment, the actual impact on investment flows will depend on global oil and gas market conditions, investor confidence, and Nigeria’s ability to enforce and maintain these new regulations effectively.

The upstream outlook

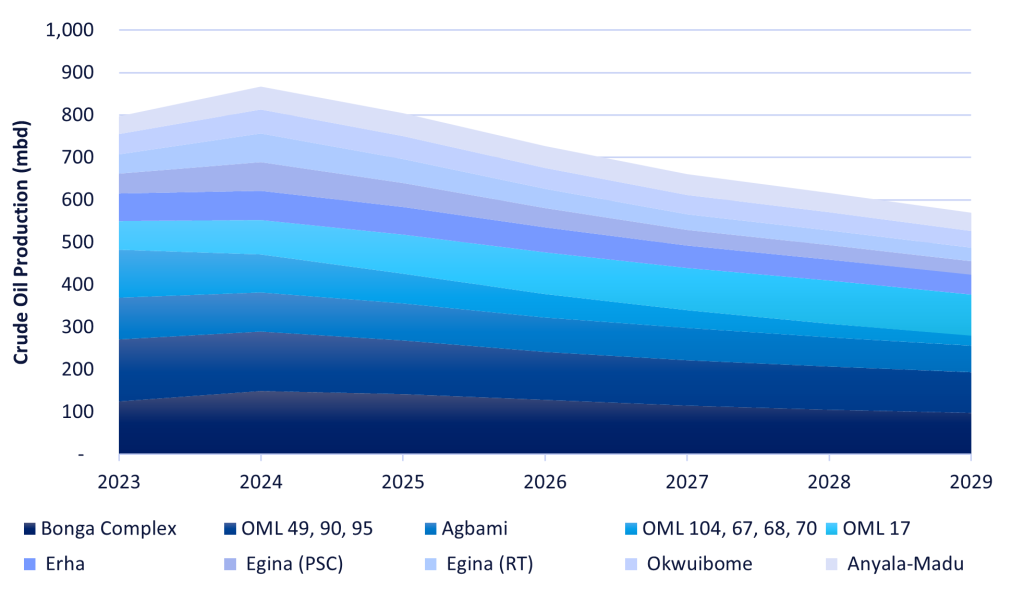

The outlook for oil and condensate production in Nigeria does not appear promising shortly. Although oil production is expected to continue increasing until 2027, it will subsequently decline due to the natural depletion of large fields that have historically been the backbone of Nigeria’s upstream industry, namely the Bonga Complex, OML (49, 90, 95) and Agbami fields.

The scenario for natural gas production is not much different, as production rates are projected to rise until 2028 before starting to decline due to the lack of investments in new projects. The weak investment in the gas sector is expected to negatively impact Nigeria’s LNG exports, which have seen significant declines in recent years due to a shortage of feedstock gas supplied to liquefication plants, now operating at approximately half of their production capacity.

Major oil fields in Nigeria set for production declines under current development plans (2024)

Nigeria currently has six LNG trains, all located on Bonny Island, comprising a total capacity of approximately 22 million tonnes per annum (mtpa). Nigeria LNG Limited (NLNG) took the final investment decision (FID) for the construction of the seventh train in 2019, aiming to boost Nigeria’s LNG production capacity to 30mtpa in the second half of the current decade. A robust progress has been made in the construction of the new train, however, concerns have recently been raised over the future of feed gas for this new train.

Bottom line

Despite Nigeria’s enactment of a new law to reform the upstream industry in 2021, structural problems remain, in particular, security issues that threaten the facilities and safety of workers in the oil and gas industry. These issues have led many Western companies to exit the Niger Delta region, the heart of Nigeria’s oil industry. Without a comprehensive and sustainable resolution of these security challenges, it may be difficult to revive the upstream sector again.