GlobalData’s latest report, ‘Ghana Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations and Competitive Landscape’, discusses the power market structure of Ghana and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

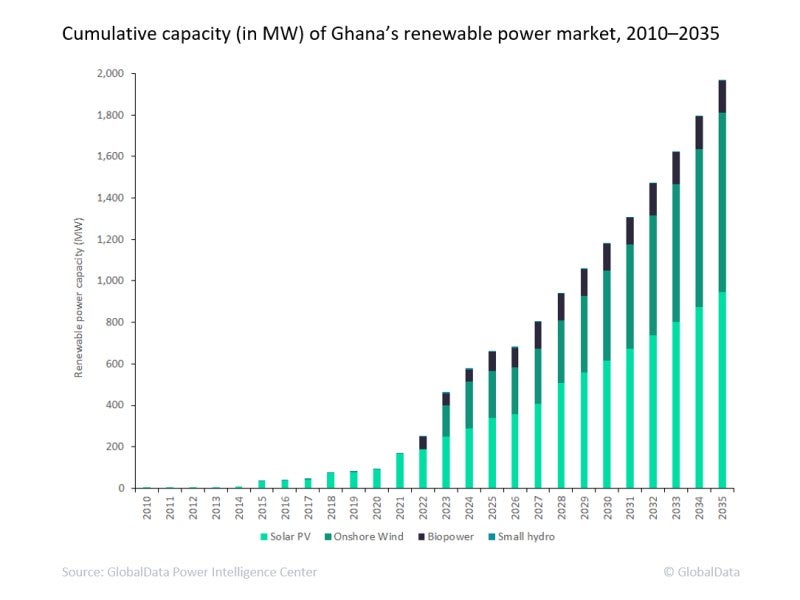

Renewable energy is a major area of investment in Ghana, as the country is rich in resources such as biomass, solar, wind and hydropower potential, says GlobalData. The leading data and analytics company notes that with the demand for electricity surging 10% annually, renewable capacity is expected to increase to 1,969.5MW in 2035, at a compound annual growth rate (CAGR) of 19.1%.

The Ghanaian Government has been actively encouraging the use of renewable sources for energy generation to reduce its dependence on fossil fuels. For instance, the government established the Renewable Energy Act of 2011 (Act 832), which provides support towards the utilisation and development of renewable resources and investments. Ghana’s installed renewable capacity stood at 170.1MW in 2021, having increased from 2.8MW in 2010 at a CAGR of 45.1%. Solar photovoltaic (PV) and onshore wind constitute most of the installed renewable capacity.

As the Ghanaian economy is slowly recovering from the Covid-19 pandemic, potential investment opportunities have emerged in line with the Sustainable Development Goals and climate pledges made under the Paris Agreement. The Ghanaian Government has pledged to scale up the penetration of renewable energy by 10% by 2030 under the Paris Agreement. Furthermore, under Ghana’s Integrated Power Sector Master Plan 2019, a major capacity amount through solar and wind power is aimed to be installed between 2022 and 2030, which is also part of the Renewable Energy Master Plan (REMP).

Ghana requires huge investment to drive the power industry’s transformation. Local manufacturers and assemblers of renewable energy technology are urgently needed if the country is to add more renewable sources.

To make the renewable sector more attractive to investors, the government is providing various incentives to increase the contribution of renewable energy to total power supply sources. Investing in the renewable sector would bring great perks for the country in terms of reduced air pollution levels and less dependency on imported fossil fuel resources.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGhana’s power sector challenges emerged from its traditional dependence on hydropower and its deciding environment. Installed hydropower capacity accounted for 54.1% of the county’s total installed capacity, with thermal power providing most of the remaining share at 45.8% in 2010. Severe water shortage resulted in the fall of hydropower to 29% share of total installed capacity in 2021. Although generation from hydropower has provided baseload power for a long time, rapidly increasing peak demand will make it necessary for the country to reduce its dependence on it in future. The country aims to reduce dependency by looking to develop renewable power capacity.