The Middle East is poised to contribute substantial additions to global LNG liquefaction capacity, projected to account for more than 10% of the worldwide increase by 2030. This expansion is propelled by a confluence of factors: the region’s abundant natural gas reserves and the robust global demand for natural gas. As a transitional fuel pivotal to energy transition initiatives and carbon emission reduction efforts, natural gas continues to play a significant role in shaping the energy strategy of several countries.

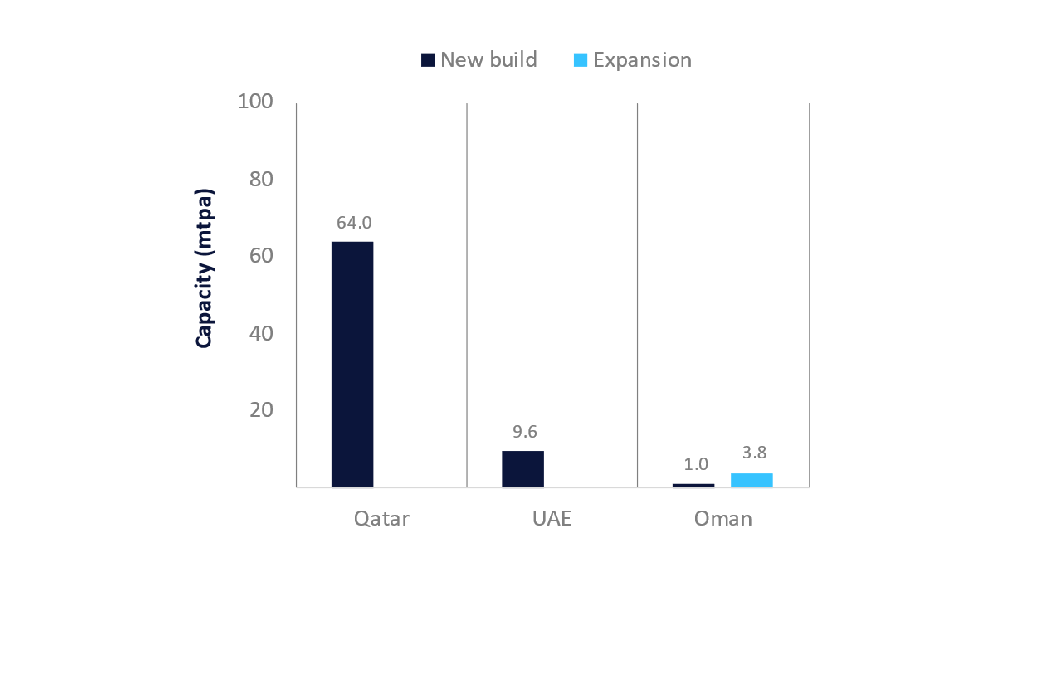

Qatar is poised to become the predominant force in the Middle East, projected to account for more than 70% of the region’s total capacity additions by 2030. This substantial expansion can be attributed to the nation’s extensive natural gas reserves, which are one of the largest in the world. The forthcoming liquefaction terminals — North Field East, North Field South, and North Field West are anticipated to play a pivotal role in propelling the increase in liquefaction capacity by 2030.

The North Field East LNG terminal is at the forefront of the Qatar liquefaction capacity additions with 32.0 million tonnes per annum (mtpa) of capacity likely to be added during the outlook period. It is considered one of the world’s largest LNG projects to date and is crucial for Qatar’s energy strategy. QatarEnergy is the proposed operator, as well as the majority (75%) stakeholder in the terminal, which is currently in the construction stage and is likely to begin operations in 2026. Big oil companies such as Exxon Mobil Corp (6.25%), Shell (6.25%), TotalEnergies SE (6.25%), ConocoPhillips (3.13%), and Eni SpA (3.12%) hold the remaining equity in the terminal.

The UAE is also expected to add considerable liquefaction capacity additions in the Middle East, with nearly 9.6mtpa of capacity expected to be added by 2030. Al Ruwais, a planned terminal owned and operated by Abu Dhabi National Oil Co, is expected to account for the entire capacity additions during the outlook period. The terminal is likely to start operations in 2028 and will have the distinction of being the first facility to run on clean energy in the Middle East and Africa region.

Further details of global LNG liquefaction capacity and capital expenditure analysis can be found in leading data and analytics company GlobalData’s new report LNG Liquefaction Industry by Capacity and Capital Expenditure with Details of All Operating and Upcoming Terminals to 2030.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData