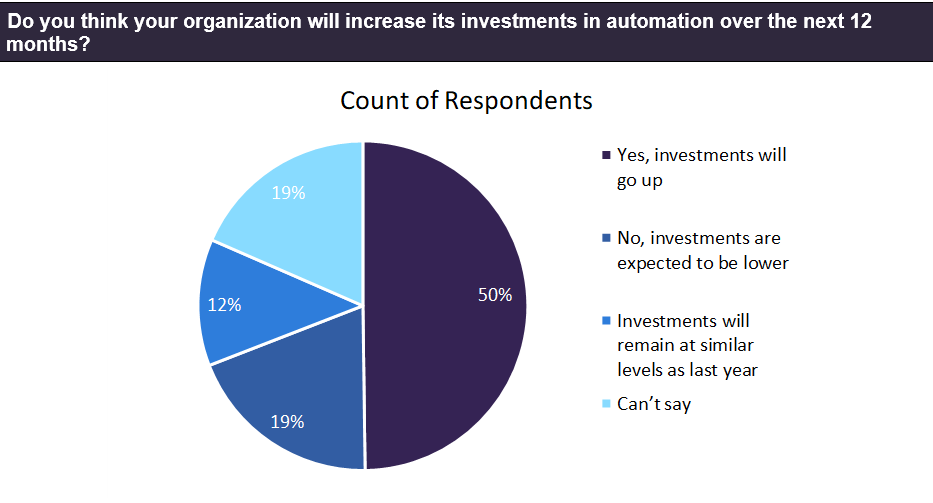

Digital tools have significantly improved operational performance and reduced costs in oil and gas operations by automating manual, resource-intensive tasks. Companies are implementing these tools across various processes in the value chain to enhance efficiency through better data visibility. Additionally, these tools minimise human involvement in hazardous environments, contributing to increased operational safety. But any new initiative requires sustained commitment for its effective application across the organisation. This comes at a cost, which often becomes a hurdle in the mass rollout. To ascertain if this was indeed the case for automation within the oil and gas industry, leading data and analytics company GlobalData conducted a poll among its readers on the investment outlook for automation over the next 12 months. The poll answered by professionals from over 50 countries generated 233 responses, with half of them indicating that the investments will go up. This was in line with the general positive sentiment towards automation technologies within the industry. Companies around the world are grappling with the challenge of finding capable frontline workers to do their tasks. As experienced field staff move on to other, less risky job roles, the need for automation becomes even more profound. As a result, companies will continue allocating some share of their budget for the implementation of automation technologies, including robotics, AI, and Internet of Things.

Nearly two-fifths of the respondents to this poll stated that their organisation’s spend on automation technologies might decline in the near future. Different organisations go through their own financial cycles of revenue generation, free cash flow, and profitability that may determine their investment priorities. At times, companies may have plans to undertake any major acquisition or invest in a new greenfield facility. In such cases, certain investments may take a back seat for a brief period. Nevertheless, automation is critical for the oil and gas industry in the longer run and will feature prominently in the capital plans of most organisations.

Around 12% of the respondents indicated that their organisation is likely to maintain its automation investments at the same level as the previous year. This also implies a consistent approach towards deploying these technologies within their operations.

Lastly, around 19% of the respondents couldn’t give a specific answer on their organisation’s investment preferences, perhaps due to limited visibility on this aspect.