GlobalData’s latest report, ‘Asia-Pacific Oil and Gas Projects Outlook to 2026 – Development Stage, Capacity, Capex and Contractor Details of All New Build and Expansion Projects’ indicates that Asia-Pacific is expected to have 2,030 projects begin operations between now and 2026. Of these, 249 would be upstream projects, 506 would be midstream and 209 refineries. Petrochemicals would account for most of the projects, with 1,066 due to begin over the four-year period.

The petrochemicals sector leads when it comes to the number of total upcoming projects during the period 2021–2025, accounting for 53% of the projects. The Midstream segment follows, in which the pipelines segment alone constitutes 38% of all midstream projects, followed by liquid natural gas (LNG) and oil storage with 28% and 25% respectively.

New build projects dominate the upcoming projects landscape in the Asia-Pacific, constituting around 77% of the total projects across the value chain. The share of new build projects is especially high in the petrochemicals sector, at more than 85%, while expansion projects dominate the downstream (refineries) sector.

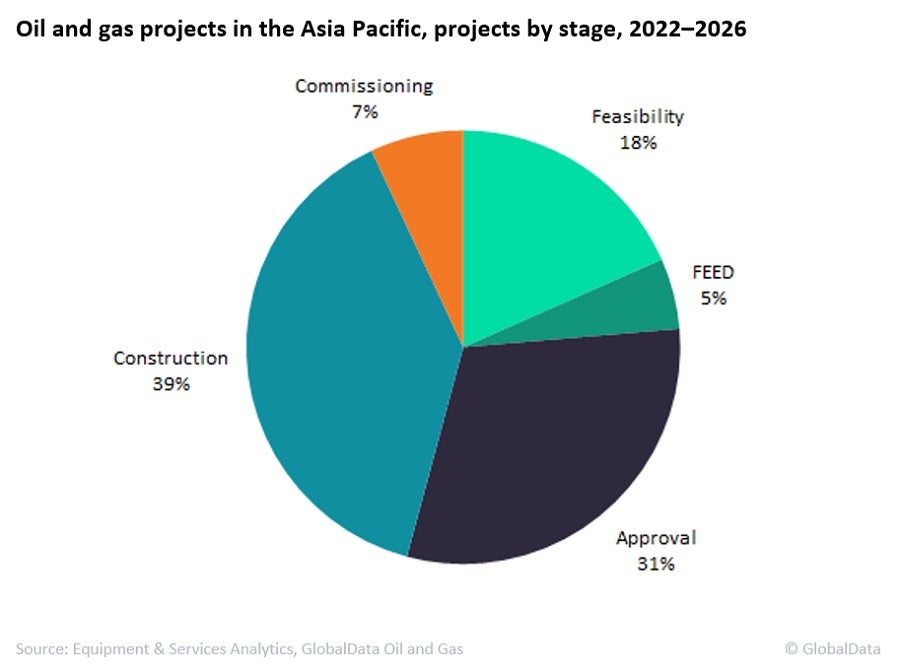

About 46% of the projects in the Asia-Pacific are in construction or commissioning stages and are more likely to begin operations during the outlook period. Around 31% of the projects have been approved or awaiting approval, while the rest are in the planning stages. Among countries, China and India lead the upcoming projects landscape in the Asia-Pacific, together accounting for 64% of the total projects that are expected to start operations during the 2022-2026 period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData