For decades, the Middle East has derived its wealth from its plentiful reserves of oil and gas. The low production costs coupled with a lack of government legislation to incentivise other forms of energy consumption have rendered fossil fuels the cheapest option for many, thus explaining the slow uptake of renewable energy in this region. Fortunately, in recent years, an increase in efforts supporting renewables has shown that countries in the region are gradually shifting to sustainable alternatives.

GlobalData’s most recent report on Energy Transition in the Middle East shows that the power mix in Middle Eastern countries is dominated by thermal power, which accounted for more than 90% of the total energy consumption in 2021, with the main source of fuel being natural gas. Despite emerging efforts to gradually eliminate reliance on fossil fuels, external factors, such as Russia’s invasion of Ukraine, have acted to foil any significant progress. Being the world’s second-largest supplier of natural gas after North America, the sanctions imposed on Russia have forced the rest of the world to seek other sources instead, resulting in a projected spike in natural gas production in the coming decade for Middle Eastern countries. Meanwhile, oil-fired generation capacity is expected to decline by nearly 30% in 2030. This disparity owes itself to the rising demand for lower-carbon fuels, favouring natural gas rather than oil and coal.

Compensating with carbon capture

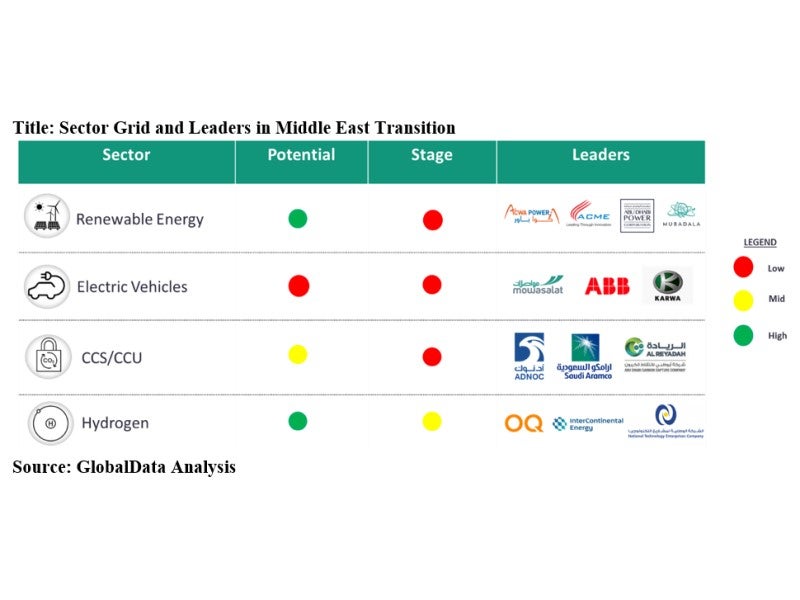

The rise in demand for natural gas has indirectly accelerated the development of carbon capture technology. Essentially, the transition to clean energy is not occurring at a pace quick enough to meet demand, necessitating continual production of fossil fuels to compensate for the short supply. By integrating carbon capture into oil and gas facilities, emissions can be reduced without compromising the region’s economic strength and energy security. Carbon capture and storage (CCS) technology can be seen as an effective tool in facilitating the transition between traditional and renewable energy generation.

While no legislation has been implemented to include CCS technology in existing facilities, there has been increasing interest in encouraging its development. To prove this point, Saudi Arabia unveiled an investment fund established specifically for CCS projects at the Middle East Green Initiative Summit in 2021. Current projects in Abu Dhabi capture up to 5mtpa of CO₂ emissions per year, making them one of the biggest such operations in the world.

Policies and partnerships on clean technologies

Despite the lack of energy policies for renewables in the United Arab Emirates (UAE), advanced emirates, such as Abu Dhabi and Dubai, have taken robust initiatives to enforce policies in their individual domains. One such example is the regulatory policy for electric vehicle (EV) charging infrastructure released by the Abu Dhabi Department of Energy in May 2022, aiming to establish a concrete framework for the ownership and management of EVs. It is, after all, the existence of proper legislation that underpins the efficacy of new technologies and ideas, evidenced by the successful roll-out of government-mandated Covid-19 vaccines in the past year. The Qatari initiative to fully electrify its public transportation is also a commendable one made possible by the vigorous efforts of the Qatar Free Zones Authority to commission e-bus factories.

The abundance of natural gas reserves paves the way for Middle Eastern countries to spearhead hydrogen projects and become major hydrogen exporters. Their strong hydrogen production capabilities are substantiated by the eagerness of future hydrogen-importing countries, such as Germany and Japan, to form well-established partnerships, such as the UAE-Germany Hydrogen Partnership, Saudi Arabia-Germany Hydrogen Agreement and UAE-Japan Agreement, to name a few. Interest from abroad, along with financial support by local authorities contribute towards the proliferation of hydrogen-based projects, including plans to construct an ammonia production plant in Neom. However, efforts are mainly concentrated in the Gulf countries.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDon’t keep all your energy in one basket

Oil and gas corporations are exploring sustainable substitutes to current energy generation methods, diversifying their assets, pouring funds into the development of renewable technology, such as solar, wind, nuclear, hydro and biopower. The UAE is projected to increase its shares in renewables generation from 4% in 2020 to a staggering 22% in 2025, according to GlobalData’s latest report.

With its vast landmass, composed mostly of deserts, and exposure to intense solar irradiation, the Middle East is especially well positioned for the exploitation of solar power. As such, there have been initiatives to do exactly that, one of which being the development of the Al Kharsaah Solar PV IPP Project – an 800-megawatt solar plant near Doha, Qatar. This is one of many steps taken by Qatar to realize its goal of hosting a low-carbon FIFA World Cup 2022. Meanwhile, Dubai boasts the world’s largest single-site solar park, with an estimated capacity of 5,000MW. With all the relevant measures in place, the Middle East is set to replace 15% of its power mix with solar energy by 2030.

Related Company Profiles

CCS Inc.

EVS, Inc.