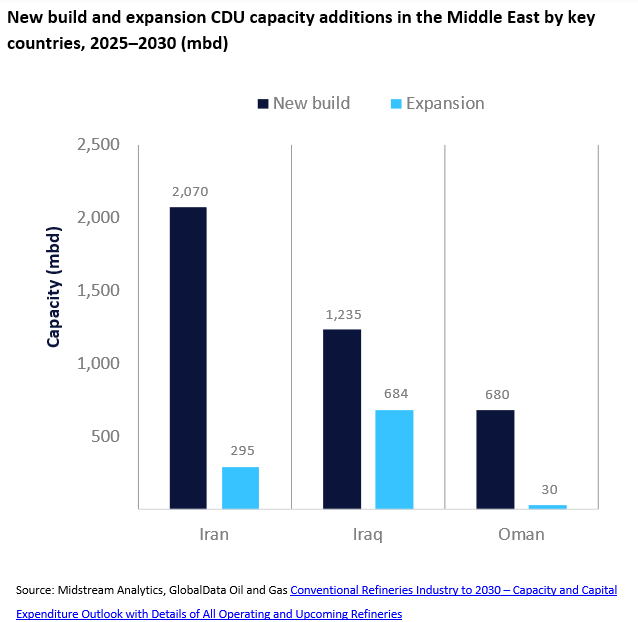

The Middle East will witness substantial crude distillation unit (CDU) capacity additions representing more than a quarter of the global CDU capacity additions by 2030. This growth is driven by growing domestic demand for refined products, the availability of vast crude reserves, and investment in modernisation and expansion projects.

Iran will dominate within the Middle East, accounting for almost 40% of the total capacity additions by 2030. This significant growth is largely due to its substantial investments in refinery modernisation, aimed at enhancing its export capabilities, particularly to Asian, African and Latin American countries. Key upcoming refineries including Jask II, Bandar Jask and Shahid Ghasem Soleimani are expected to be instrumental in driving the CDU capacity additions by 2030.

The Jask II refinery is at the forefront of Iran’s CDU capacity additions with 600 thousand barrels per day of CDU capacity likely to be added during the outlook period. Petro Tejarat Shahin Co is the 100% owner as well as the proposed operator of this refinery, which is currently at the front-end engineering design stage and likely to begin operations in 2028.

Iraq is also expected to add considerable CDU capacity additions in the Middle East with almost 1,919 of capacity expected to be added by 2030. Within Iraq, the Basra II, a planned refinery, owned and operated by South Refineries Co, is poised to lead the CDU capacity additions with 300 mbd likely to become operational in 2027.

Further details of global conventional refineries capacity and capital expenditure analysis can be found in GlobalData’s new report, Conventional Refineries Industry to 2030 – Capacity and Capital Expenditure Outlook with Details of All Operating and Upcoming Refineries.