Liquified natural gas (LNG) deals with the transport of natural gas across continents via specially designed tankers or LNG carriers.

It provides gas-deficit countries an alternate way to procure this commodity, where pipeline connectivity is practically not feasible.

In 2022, LNG prices skyrocketed after the start of the Ukraine conflict as Europe attempted to reduce its dependence on piped Russian gas.

This pushed LNG cargoes out of reach of weaker economies such as Pakistan, compelling them to burn more coal for power generation.

Although relatively mild late-year temperatures in 2022 eased these concerns to some extent, LNG prices have the potential to rise once again in the same period this year.

Against this backdrop, GlobalData, a leading data and analytics company, conducted a poll in June-July 2023 to assess the overall sentiment towards the LNG segment and its commercial viability.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

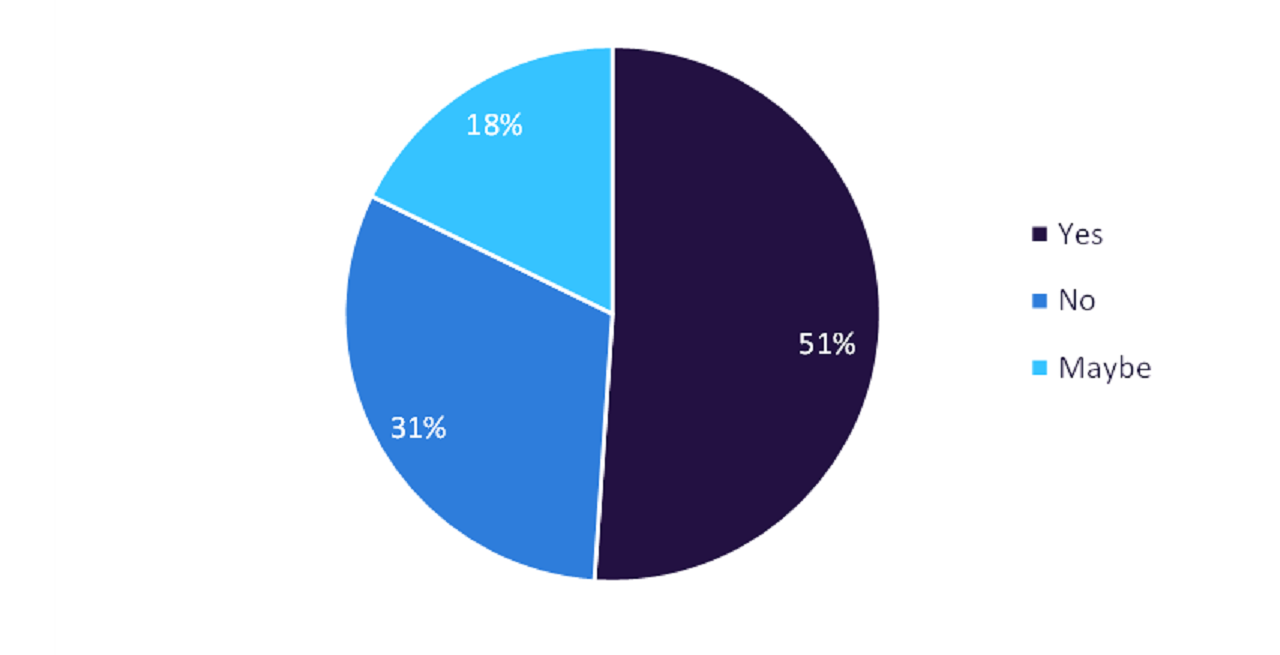

By GlobalDataThe poll was answered by 231 respondents via this portal, and a majority of them agreed on the affordability of LNG in meeting global energy needs.

More than half of the respondents indicated that LNG would be an affordable energy source even amid the protracted conflict in Ukraine.

This might be attributed to the wave of new liquefaction and regasification terminals that are anticipated to come online in the coming years, which would potentially ease pricing concerns.

According to GlobalData, there are 67 LNG liquefaction terminals operational globally as of 2023 with a cumulative design capacity of more than 482 million tonnes per annum (mtpa).

A further 12 terminals are in advanced stages of development and are anticipated to come online by 2025, adding another 140mtpa of LNG capacity to the market.

These capacity additions could somewhat ease the pressure on LNG prices in the short term and therefore make them more affordable for developed and emerging markets.

Another 80 LNG liquefaction terminals are under various stages of development. Several of these could come online by the end of this decade to boost the global LNG capacity even more and mitigate price pressures in the medium to long term.

In contrast, nearly one-third of respondents felt that LNG cargo would not be affordable.

This opinion could be driven by developments from 2022 wherein Europe used its financial and diplomatic muscle to attract considerable LNG volumes.

Prior to the Ukraine conflict, the region was a relatively smaller market for LNG and gas pipelines from Russia, which accounted for approximately 40% of its overall imports.

However, in 2023 alone, seven new regasification terminals became operational across Europe and 26 more are under development. Thus, the region could continue to disrupt global LNG trade, thereby impacting prices.

Finally, roughly 18% of respondents expressed uncertain views on this topic.

This might be because the global geopolitical situation is still tense with the Russia-Ukraine conflict, as well as the Israel-Gaza war in the Middle East.

These conflicts add uncertainty to the global energy trade, especially because Russia and the Middle East contribute to the bulk of global energy needs.

Perhaps, a more stable geopolitical environment and steady global economic growth could help ease the commodity markets, including LNG prices.