Oil remains the bedrock of global economic growth despite growing calls for energy transition. The Covid-19 pandemic-induced demand slump in 2020, followed by the supply shock from the Ukraine conflict in 2022, have both had tremendous impacts on global oil markets. Oil demand has been strong following the easing of the pandemic-related restrictions and the revival of economic activity, passing pre-pandemic highs of 100.3 million barrels per day (mbpd) to reach 101.7mbpd in 2023, according to the International Energy Agency (IEA). The oil demand growth in 2023 was also attributed to a rise in air travel, increased use of oil in power generation and the growth of petrochemical output from China.

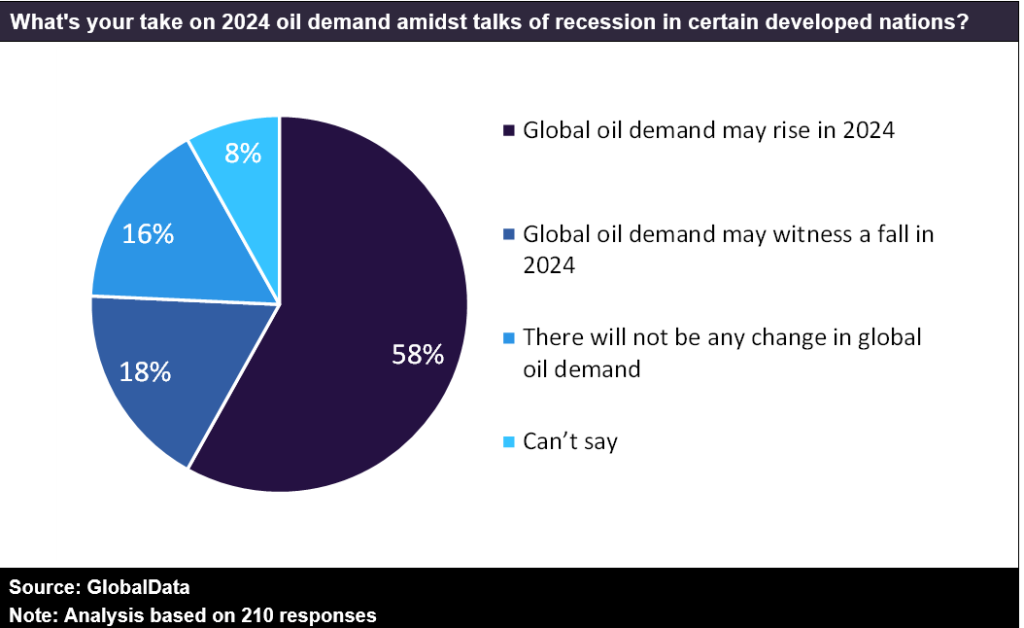

Looking ahead, it is interesting to understand the prospects for global oil demand in 2024, especially as several major economies such as Germany, Japan and the UK are in recession. Against this backdrop, GlobalData conducted a poll in January 2024 to try and gauge the industry’s opinion about the global oil demand outlook for the year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

An overwhelming majority of the respondents said that demand would rise further in 2024. The IEA, in its Oil Market Report in February 2024, estimated that global oil demand would rise by 1.2 million bpd during the year in comparison to 2023. The report indicated that this growth would come primarily from China, followed by India and Brazil. The IEA also implied that growing production from the US, Brazil, Guyana and Canada would be able to match the projected rise in demand, even if the voluntary production cuts by the OPEC+ group remain in effect.

18% of respondents said that global oil demand could witness a fall in 2024. Recession has set in in some of the major European Union (EU) countries. In a worst-case scenario, the rest of the EU could slide into recession in the second or third quarters of 2024. The US is in an election year, and policy decisions, especially on interest rates, could impact economic growth in the country.

A recession in the US can have wide implications for global economic activity. China is also experiencing a slump in its property sector, which is a key component of the country’s gross domestic product. Strong global oil inventories boosted during 2022 and 2023 could also act to lower demand in 2024.

Slightly under one-sixth of the respondents felt that there will be no change in the global oil demand in 2024. They believe that demand growth in countries such as China, India and Brazil will be offset by the recession trends in the West, leading to a flat global oil demand.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAround 8% of respondents said that they are unable to form an opinion about global oil demand during the year. A variety of factors, such as geopolitical instability, the prospect of interest rate cuts and inflation could tug the global oil demand curve either way. This set of respondents is affected by these uncertainties and therefore would not venture a guess.