Global caustic soda capacity is poised to see considerable growth over the next five years, potentially increasing from 99.06mtpa in 2021 to 106.65mtpa in 2026, registering total growth of 7.7%.

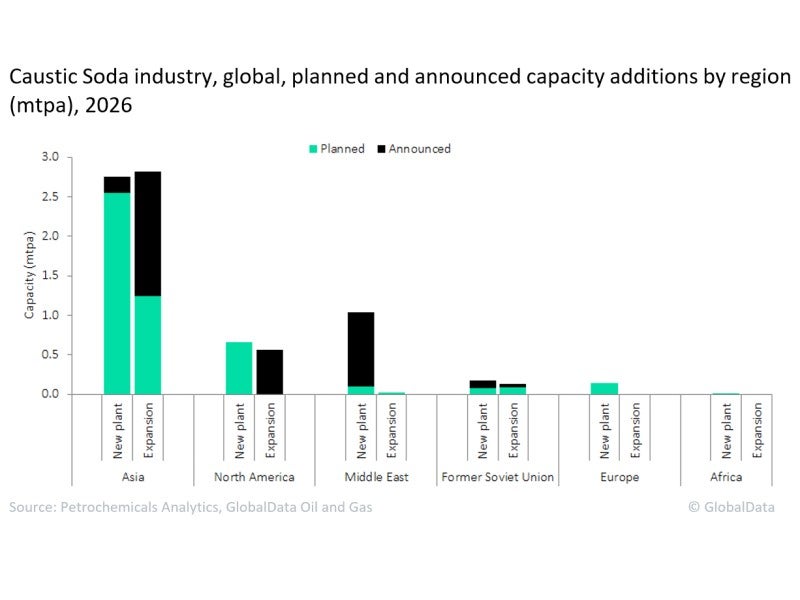

GlobalData’s latest report, ‘Global Caustic Soda Industry Outlook to 2026 Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’, states that Asia leads with the largest capacity additions for the newbuild and expansion of existing caustic soda projects by 2026.

Asia is expected to add a capacity of 2.75mtpa from 12 newbuild planned and announced projects, whereas, for the expansion of the existing caustic soda projects, the region is expected to add a capacity of 2.82mtpa from 13 planned and announced projects.

In Asia, China leads with the largest capacity additions, with a capacity of 2.30mtpa from six planned projects. The main capacity addition will be from a planned project, Xinjiang Zhongtai Chemical Company Baicheng Caustic Soda Plant, with a capacity of 0.80mtpa. It is expected to commence production of caustic soda in 2024.

North America follows next, with a capacity of 0.66mtpa from one planned project, whereas, for the expansion of the existing caustic soda project, the region is expected to add a capacity of 0.56mtpa from one announced project. The Shintech Plaquemine Caustic Soda Plant 3 planned project in the US leads with a capacity of 0.66mtpa and is expected to come online in 2022.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData