As Europe navigates its energy future, two interconnected trends are reshaping its gas market: a significant expansion in LNG capacity and the strategic phase-out of Russian gas. These trends are thoroughly analysed in the ‘Europe Gas & LNG Market Outlook 2024‘, providing critical insights into the continent’s evolving energy landscape.

LNG expansion: building resilience and capacity

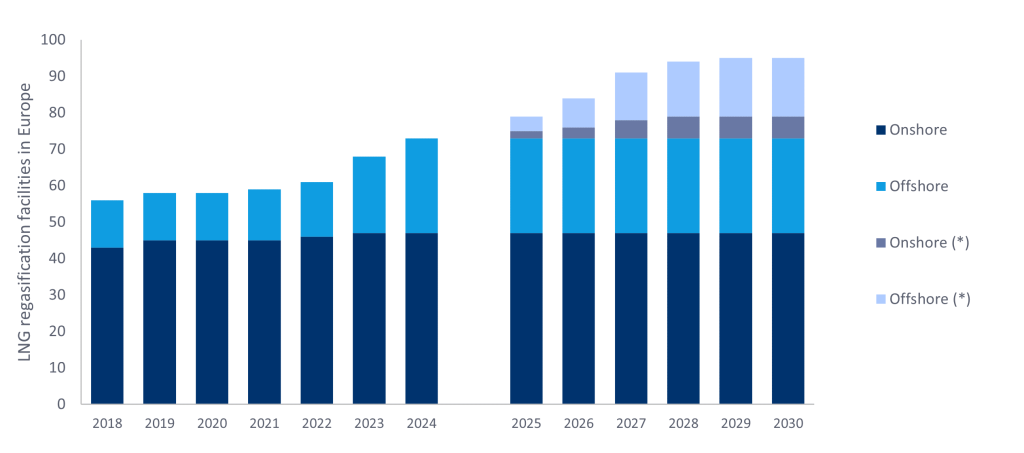

European countries are actively increasing their LNG regasification capacity, with a projected growth of 47.3% by 2030. This expansion underscores a strategic pivot towards enhancing energy security and diversifying gas supply sources in response to geopolitical instability. The continent’s regasification capacity, which stood at 10,983bcf in 2024, is expected to rise substantially, driven by significant projects across several countries.

Countries such as Germany, Spain, and the United Kingdom are leading this charge, expected to hold a 52% share of the continent’s total regasification capacity by 2030. Germany’s Stade plant, slated to begin operations in 2027, will be one of the most significant projects, boasting a capacity of 469.5bcf and an INVESTMENT exceeding $1.2bn. Similarly, Belgium’s Zeebrugge plant will see major expansions, reflecting a broader trend of substantial investment in LNG infrastructure.

A quick development of new regasification facilities followed the Ukraine invasion in 2022, especially offshore

A key factor in this rapid expansion has been the deployment of Floating Storage Regasification Units (FSRUs). These units offer a flexible and faster alternative to traditional onshore facilities, enabling countries to quickly boost their LNG import capacity. Nations like Germany, the Netherlands, and Greece are at the forefront of utilising FSRUs, with numerous units planned or already operational.

This strategic shift is further supported by long-term contracts with major LNG suppliers such as Qatar and the United States. These agreements ensure a steady flow of LNG to Europe, justifying the substantial investments in regasification infrastructure and enhancing the continent’s energy resilience.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

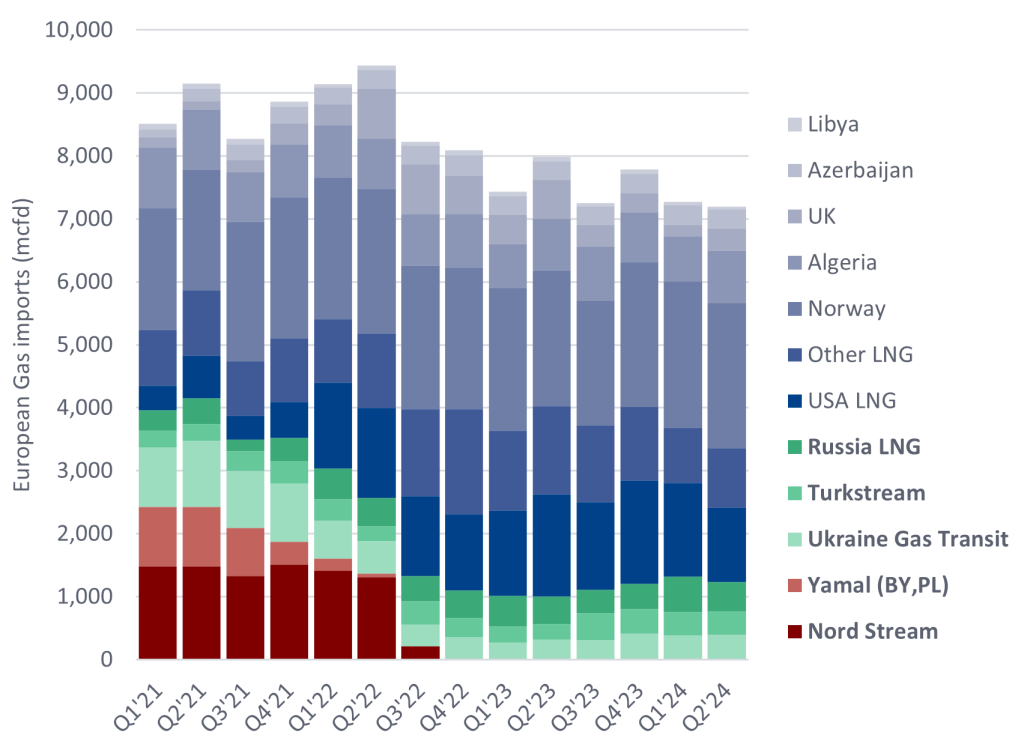

By GlobalDataRussian gas phase-out: a complex transition

The phase-out of Russian gas, a critical component of Europe’s energy strategy, has been markedly influenced by geopolitical events and decisions by Russian counterparts. The Nord Stream pipelines have been inoperative since the sabotage incidents in September 2022, effectively cutting off a significant supply route. Meanwhile, the Yamal-Europe pipeline stopped transporting gas from Russia in April 2022, a decision taken by Gazprom. Thus, Europe’s reduction in Russian gas imports has arguably been more reactive than preemptive, driven by external actions rather than a unified EU initiative.

Before the invasion of Ukraine, Russian gas accounted for a substantial 46.5% of Europe’s gas imports in 2021. This share plummeted to an all-time low of 12.6% by the summer of 2023 but has since seen a slight rebound to 18% during the autumn and winter months.

Major oil fields in Nigeria set for production declines under current development plans (2024)

Interestingly, while piped gas supplies from Russia have decreased significantly, LNG imports from Russia remain relatively stable, highlighting the complexity of completely phasing out Russian energy. Moreover, the increase in piped gas supplies by 7% in the first half of 2024, although still 75% below 2021 levels, indicates a persistent albeit reduced reliance on piped Russian gas.

Efforts to diversify gas sources have also been hampered by infrastructure and development constraints in alternative supply routes, such as Azerbaijan and the Maghreb pipeline.

In conclusion, the ‘Europe Gas & LNG Market Outlook 2024’ reveals a continent in transition, strategically expanding its LNG capacity while grappling with the complexities of phasing out Russian gas. These efforts are crucial for enhancing energy security and resilience in an increasingly volatile geopolitical landscape. For a detailed analysis and comprehensive data, the full report offers invaluable insights into Europe’s dynamic gas market.