GlobalData expects that an average capex of $7.5bn per year will be spent on 454 oil and gas fields in Australia between 2018 and 2020. Capital expenditure on Australia’s oil projects will add up to $3.8bn over the three-year period, while investments into gas projects in Australia are anticipated to total $18.7bn in upstream capital expenditure by 2020.

Deepwater projects will be responsible for over 48% of $22.5bn of upstream capital expenditure in Australia, or $10.7bn by 2020. Shallow-water projects will account for 37% of upstream capital expenditure with $8.4bn by 2020, while onshore projects will take $3.4bn in capital expenditure over the period.

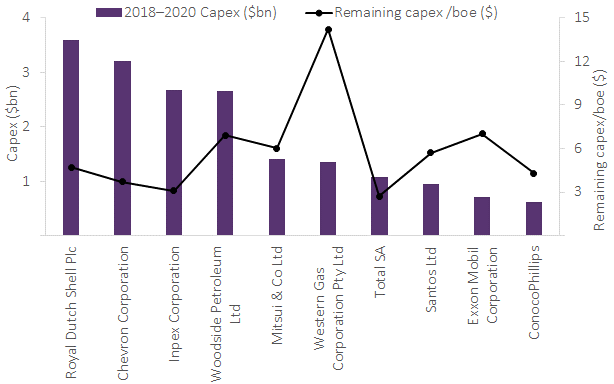

GlobalData forecasts that Royal Dutch Shell Plc will lead Australia in capital expenditure, investing $3.6bn into the country’s upstream projects by 2020. Chevron Corporation and Inpex Corporation will follow with $3.2bn and $2.7bn investment, respectively, into Australia’s projects between 2018 and 2020.

Top ten companies by capital expenditure into Australian upstream by 2020

Source: GlobalData Upstream Analytics

Ichthys LNG Project, a planned conventional gas field in the Browse Basin, will lead capital investment with $3.4bn to be spent between 2018 and 2020. INPEX Ichthys is the operator for the field. Prelude, another planned conventional gas field in the Browse Basin, follows with a capex of $3bn. Shell Development (Australia) is the operator of the field. Greater Gorgon, a gas producing field in Carnarvon Basin, will follow next with a capex of $2.6bn. Chevron Australia is its operator.

GlobalData reports the average remaining capital expenditure per barrel of oil equivalent (capex/boe) for Australian projects at $4.8. Shallow water projects have the lowest remaining capex/boe at $2.6, followed by onshore and deepwater with $3.6 and $7.9 respectively.