Since the start of the Russia-Ukraine conflict in February 2022, the EU has actively worked to reduce its dependence on Russian commodity imports, particularly natural gas via pipelines. By 2023, the region had succeeded in lowering its gas imports from Russia to 15% of its total imports, down from around 45% before the conflict. The US liquified natural gas (LNG) industry was the biggest beneficiary of this shift, becoming a key supplier for markets in Europe and Asia. LNG terminals across Louisiana and Texas, including Port Arthur and Rio Grande, secured several large long-term LNG contracts since the start of the conflict, and the country’s LNG exports hit record highs in 2023.

As profitability among US natural gas producers and LNG exporters skyrocketed, it encouraged companies to evaluate LNG export capacity expansions along the Gulf Coast with plans for newer terminals. Against this backdrop, the Biden administration announced an indefinite halt on all pending permits for such terminals to allow for the US Department of Energy to develop a revised criteria that would better account for the projects’ impact on climate change. The move aligned with global initiatives to transition to renewable energy and reduce reliance on LNG as a bridge fuel. However, it was largely viewed as ill-timed as LNG exports were proving to be of strategic importance amid the Ukraine conflict and positioned the US as a reliable energy supplier to demand centres around the world.

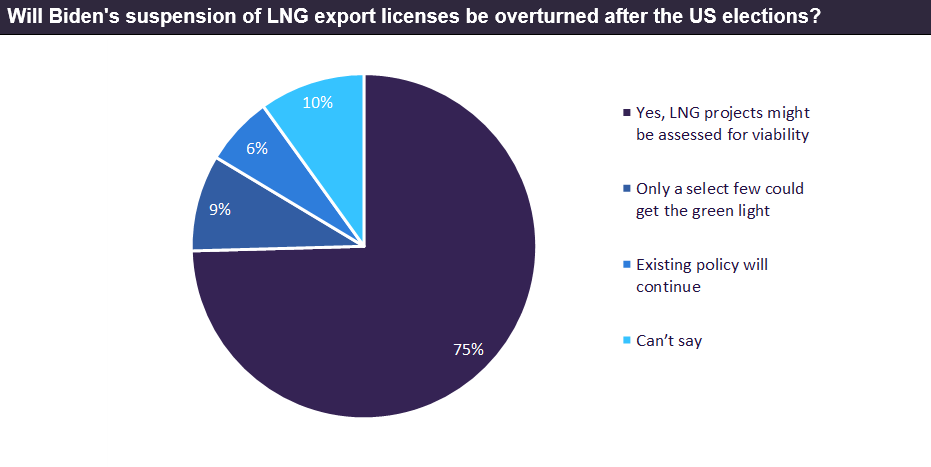

Considering this development, leading data and analytics company GlobalData conducted a poll to understand from its readers if this pause in approvals would persist even after the US elections. The poll was carried out from October to December 2024 and received 232 responses over this timeframe. About 75% of the respondents indicated that this decision would be revoked, and newer LNG terminals would get approvals as per their merits. The US LNG industry builds on the country’s shale resurgence and could help establish its energy dominance amid geopolitical turmoil elsewhere.

A small share of the respondents, around 9%, felt that only a select few proposals could get approved in the coming years. This response might be based on the rationale that with the US being one of the world’s largest LNG producers, making significant additions to this capacity may lead to a glut in future. This is presumably due to the uncertainty in the long-term outlook for fossil fuels in major demand centres, especially Europe, which had set some of the most ambitious emission reduction targets before the start of the Ukraine conflict.

An even smaller share of respondents felt that this suspension would continue for the foreseeable future. These respondents might have taken into consideration the emissions impact of LNG production, loading, and transport to distant markets. Nevertheless, several independent studies have demonstrated the overall benefits of sustained LNG exports in boosting the economy, advancing climate initiatives, and enhancing global energy security.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData