TotalEnergies has expanded its gas portfolio by acquiring full ownership of SapuraOMV Upstream, a Malaysian independent gas producer.

The deal was concluded after TotalEnergies completed its purchase of the remaining 50% stakes held by OMV and Sapura Upstream Assets, making the French company the sole owner of the Malaysian operator.

The acquisition process was divided into two phases.

In January 2024, TotalEnergies agreed to purchase OMV’s 50% interest in SapuraOMV for $903m (€859.58m), which included a $350m loan transfer.

This was followed by an April 2024 agreement to acquire the remaining 50% stake from Sapura Upstream Assets for $530m.

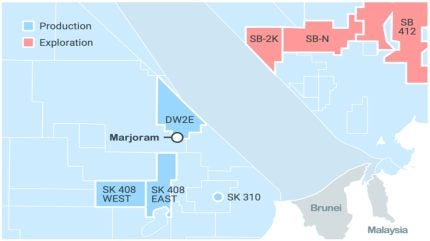

SapuraOMV, established in 2019 and headquartered in Kuala Lumpur, holds critical assets in offshore Malaysia, including a 40% stake in Block SK408 and a 30% stake in Block SK310, both located in Sarawak waters.

In July 2024, under SapuraOMV’s operation, the Jerun field commenced gas production.

The field, part of the SK408 production sharing contract, is situated 160km north-west of Bintulu and was discovered in 2014.

The Jerun field’s central processing platform is designed for a production capacity of up to 550 million cubic feet per day (mcf/d) and is expected to yield 15,000 barrels per day (bpd) of condensate at peak production.

SapuraOMV’s operated production is projected to reach approximately 590mcf/d of natural gas, primarily feeding the Petronas-operated Bintulu liquefied natural gas (LNG) plant, along with 10,000bpd of condensates.

The assets are noted for their low production costs, below $5 per barrel of oil equivalent, and an overall emission intensity below 10kg of CO₂ equivalent per barrel of oil equivalent.

Sapura Energy interim chairman Shahin Farouque Jammal Ahmad said: “This strategic initiative underscores our commitment to Sapura Energy’s long-term Reset and debt restructuring plan; this divestment streamlines our portfolio and enables us to focus on our core capabilities, namely to deliver safe and innovative solutions to the energy industry.”