CNX Resources has signed a definitive agreement to acquire the upstream natural gas and associated midstream business of Apex Energy II, a portfolio company of funds managed by Carnelian Energy Capital Management.

The deal value of $505m will be paid in cash and is subject to adjustments.

This amount will be funded with CNX’s secured credit facility.

The completion of this transaction is scheduled in Q1 2025, contingent upon the fulfilment of standard closing conditions.

CNX president and CEO Nick Deiuliis stated: “This transaction represents a rare opportunity to acquire a highly complementary asset adjacent to our existing operations. It underscores our confidence in the stacked pay development opportunities that have been unlocked from pioneering the deep Utica in this region.”

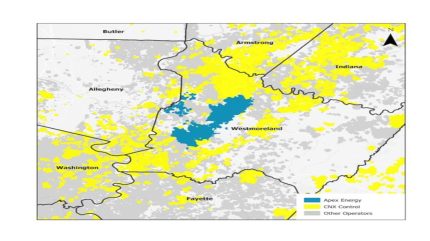

This acquisition is poised to broaden CNX’s existing undeveloped Marcellus and Utica leasehold in the CPA region.

It also includes an existing infrastructure footprint that can be utilised for future development.

The company foresees operational and other developmental synergies that are expected to incrementally bolster the core business in the forthcoming years.

CNX predicts that the acquisition will contribute to an increase in the company’s key metric of free cash flow per share.

In May 2024, CNX modified its secured credit facilities, extending the due dates to May 2029 and augmenting the total elected commitment amounts to $2bn.

As of 30 September 2024, CNX reported having roughly $1.8bn of available borrowing capacity under these credit facilities.

Following the acquisition, the company anticipates that leverage ratios will be minimally affected, thereby preserving its considerable capital allocation flexibility.