The long-anticipated Angola LNG project is an integrated gas utilisation scheme comprising offshore and onshore operations. These will commercialise gas resources from the country’s offshore blocks and boost the development of a future natural gas-based industry.

In December 2007, the final investment decision was made on the project after years of planning, which began back in the 1990s when Angola’s government and state operator Sonangol gave the green light to the project consortium to begin its development.

The project is expected to generate $180m through the sale of carbon credits. It will help reduce 13 million tonnes of carbon dioxide emissions. Each tonne of carbon can be traded at $14, which translates into $182m in annual income.

LNG train

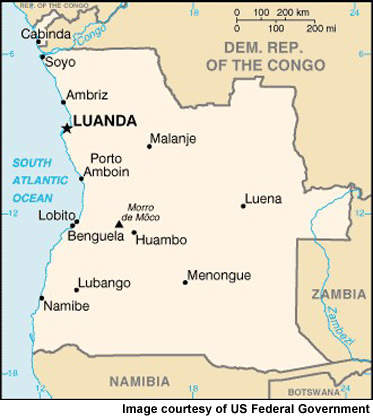

The programme involves the construction of a single liquefied natural gas (LNG) train with a production capacity of 6.8 billion cubic metres a year (5.2 million tonnes) adjacent to the coastal town of Soyo, 350km north of Luanda. Consuming around one billion cubic feet of gas a day, the plant has a projected lifespan of 30 years. At a cost of $4bn, the project represents the largest single investment in Angolan history. First production will take place in the first quarter of 2012.

Chevron is the lead partner through its subsidiary Cabinda Gulf Oil Company, which owns a 36.4% share. The other consortium members are national oil company Sonangol – as Sonagas – with 22.8% (having sold 13.6% to Eni in 2006), BP and Total with 13.6% each.

Reserves and resources

The Angola LNG project has estimated natural gas resources amounting to 297 billion cubic metres (10.5 trillion cubic feet). The plant’s primary source of supply in the early years of operation was from associated fields, helping to reduce gas flaring and facilitate oil production.

It is anticipated that non-associated gas from previously discovered gas fields will ultimately form the feed to the plant, as oilfields mature and associated gas production declines. Much of Angola’s deep and ultra-deepwater areas are considered highly prospective and still await exploration.

Gas resources arising from a number of blocks have been exclusively designated for the project. These reserves, lying in water depths of up to 1,500m are to come from blocks 0 and 14 (Chevron), 15 (ExxonMobil), 17 (Total) and 18 (BP), along with future ultra-deepwater blocks and previously discovered non-associated gas fields in blocks 1 and 2.

The gas produced in these designated blocks will be transported onshore to the new LNG plant by high-pressure pipelines to undergo conditioning and extraction of the natural gas liquids before liquefaction to LNG.

Soyo LNG plant

A joint venture of JGC Corporation, KBR and Technip was awarded the front-end engineering design contract for the facility in 2005.

Work to prepare the plant site will be carried out by a Boskalis International/Jan de Nul Dredging joint venture, with the necessary advanced engineering and procurement awarded to Overseas Bechtel.

The plant will benefit from the ConocoPhillips-Bechtel Global LNG Collaboration, using ConocoPhillips’s Optimised Cascade LNG process to produce LNG from the feed derived from the offshore gas fields. The new plant will also process propane and butane LPGs and condensate, and will provide Sonangol with up to 125 million cubic feet of gas daily for the domestic market under gas supply, sales and re-gas agreements.

Construction work will also include storage and marine loading facilities for LNG, LPG and condensate.

Contracts for the Angola LNG project

Dredging International was awarded a contract to carry out works for the Soyo LNG port. The scope of work includes installing navigation aids, navigation buoys and optional maintenance works.

Bechtel contracted Dresser Masoneilan to supply control valves for the project, and Alcatel-Lucent will provide communication systems.

Marine engineering for the project was carried out by China Harbour Engineering Company. Acergy was contracted in September 2009 to install a 70km pipeline transport LNG onshore to the LNG facility.

In December 2011, GAC was awarded the contract to provide port and bunker fuels services for the project.

Monetising the gas market

The first gas will be shipped from the plant in 2012 to the Gulf LNG Mississippi regasification terminal – to be built near Pascagoula – for subsequent sale throughout the US. A subsidiary of Sonangol has a 30% holding in the $1.2bn project, while the facility has a 20-year supply deal with Sonangol.

The upshot is widely expected to establish Angola as a primary competitive source of LNG for a global and fast-developing natural gas market. As a result, the Angola LNG project is set to bring a number of national benefits, including commercialising natural gas resources, prioritising the further exploration of oil and natural gas and, by providing a source of natural gas for domestic use, stimulate further economic growth.