McDermott International has entered into an agreement to sell its CB&I storage business unit to a consortium led by Mason Capital Management.

The sale is expected to generate $475m in pre-tax before taxes proceeds for McDermott, excluding transaction expenses.

The decision to sell follows a comprehensive marketing process where McDermott received multiple bids.

McDermott plans to use the proceeds from the sale to repay CB&I’s term loan, cash collateralise certain McDermott letters of credit and reduce an existing McDermott term loan, in line with the terms of McDermott’s credit agreement.

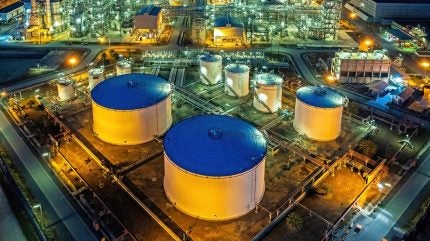

CB&I, with a global presence, is engaged in designing and constructing storage facilities, tanks and terminals.

It became a part of McDermott in 2018 following a merger.

In 2023, McDermott took measures to bolster the storage business by providing a dedicated capital structure.

McDermott president and CEO Michael McKelvy said: “The significant interest expressed in our storage business is a direct reflection of its long history of providing customers world-class storage solutions and its bright future.

“We believe this is the best transaction for our business, CB&I, its customers and employees.”

Mason managing member and principal Mike Martino said: “We are pleased to reach this agreement to acquire and serve as the future stewards of CB&I.”

The transaction is expected to complete in the fourth quarter of 2024.

McDermott recently secured a contract from QatarEnergy LNG for the North Field South offshore pipelines and cables project.

The contract is aimed at boosting Qatar’s liquefied natural gas production capacity from 77 million tonnes per annum (mtpa) to 142mtpa.