Global oil and gas contracts activity reported a decrease of 22% in the number of contracts from 7,550 in 2022 to 5,915 in 2023. Despite the decline in the number of contracts, the total disclosed contract value remained stable at $187.48bn in 2023, only slightly lower than the $189.94bn reported in 2022.

This resilience is credited to the significant high-value contract contribution from renowned contractors such as Technip Energies and Consolidated Contractors $10bn Engineering, Procurement, Construction, and Commissioning (EPCC) contract for QatarEnergy’s North Field South two 8mmtpa LNG trains project. Tecnimont’s $8.7bn, and Saipem and NPCC Consortiums’ $8.2bn Engineering, Procurement, and Construction (EPC) contracts for the Hail and Ghasha Development Project in Abu Dhabi, UAE, as well as Yinson Holdings’ $5.3bn Agogo FPSO charter and operation and maintenance work, and Hyundai’s $5bn EPC work for Mixed Feed Cracker (MFC) and Utilities, Flares & Interconnecting facilities at the Amiral petrochemicals facility expansion in Saudi Arabia.

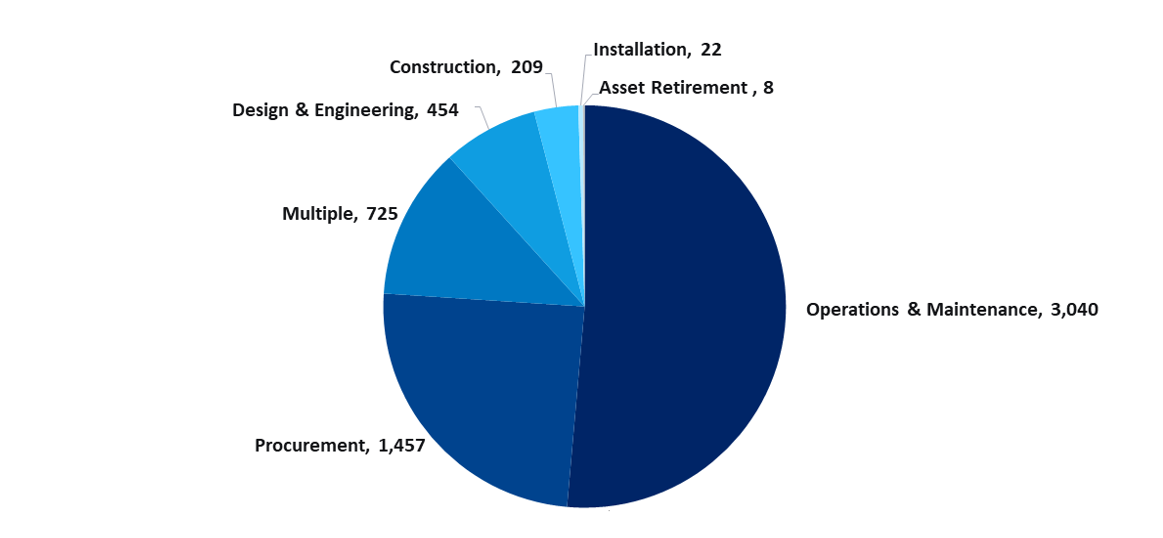

Operation and Maintenance (O&M) represented 51% of the total contracts in 2023, followed by contracts with procurement scope with 25%, and multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, accounted for around 12%. Overall, Saipem was the top contractor, with contract value totalling $21.71bn during 2023, followed by HD Hyundai with contract value totalling $17.43bn. ADNOC was the top issuer, with contracts worth $29.85bn, followed by Saudi Aramco with a contract value of $24.3bn.

Further details can be found in GlobalData’s new report, Oil and Gas Industry Annual Contracts Analytics by Region, Sector, Planned and Awarded Contracts and Top Contractors.