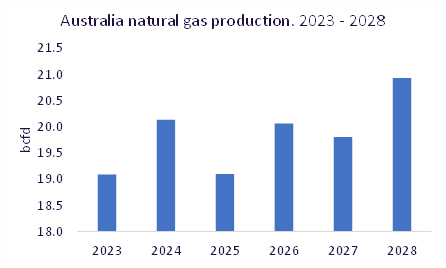

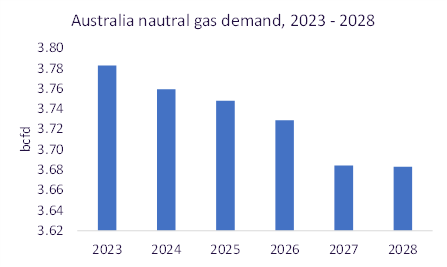

Australian supply of natural gas vastly outweighs its domestic demand, allowing it to become one of the world’s largest exporters of LNG. Around 75% of Australian-produced LNG is exported, primarily to the Asian market. Australia is the primary supplier for many countries in the region, such as Japan, which obtains almost half of its LNG from Australia.

Effect of Global Events

Australian gas producers suffered as a result of reduced demand during the pandemic, which also delayed the construction of several planned LNG projects. However, the start of the Russia-Ukraine war caused Europe to lose access to Russian piped gas, which in 2020 made up 41% of Europe’s total gas imports. In an attempt to replace this lost Russian gas and maintain energy security, European demand for Australian LNG increased, driving up demand and prices and allowing the market to return to pre-pandemic levels. This new European demand has had adverse effects on smaller, less developed countries in Asia such as Bangladesh, which previously imported LNG from Australia but has been outbid due to these recent price hikes.

GlobalData’s recent Australia Gas and LNG Market Outlook report forecast that in the coming few years, the market will relax as it adjusts to the war and as such it is likely that Australia will revert to its prior Asian market, thanks to new US and Qatari LNG projects scheduled to become operational.

Government Intervention

In response to spiking prices due to increased global demand, the Australian government introduced a cap of $12 (AUD) per gigajoule on wholesale gas prices towards the end of 2022 which was more recently extended till at least mid-2025. Treasurer Jim Chalmers, Energy Minister Chris Bowen and Resources Minister Madeleine King made a joint statement announcing the decision.

It stated that the price cap extension would ensure “reasonable prices” for Australian users while allowing Australia to remain a “reliable trading partner” and give producers the certainty needed to invest. Exemptions to this price code have been put in place for small producers supplying the domestic market, as well as for larger producers who make court-enforceable domestic supply commitments.

This increase in regulation and incentivised diversion of LNG into the domestic market, combined with a reluctance to replace emptying gas fields and heightened activist litigation against new LNG projects, have fuelled concerns about Australia “quiet quitting” the LNG market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataReports

Australia Gas and LNG Market – Supply and Demand Outlook by Production Breakdown, Power Capacity, Consumption and Usage by Industry and Upcoming Projects, 2023

In the first year of Albanese’s new Labor government, concerted efforts have been made to meet campaign promises of stricter environmental policies regarding emissions targets and a move towards renewable energy sources. In a piece for the Oxford Institute for Energy Studies, Graeme Bethune (chairman of EnergyQuest, an independent Australian energy advisory company) said that investors were “right to be concerned” about the government’s attitude towards LNG going forward.

Looking to the Future

Nevertheless, there are a handful of upcoming projects scheduled to come online by 2026. Woodside Energy is aiming to expand its fields in the Carnarvon basin off the northwest coast, with two new targets for additional gas fields at Scarborough and Browse, as well as Pluto Train 2, an LNG train used to transport the gas to an existing onshore facility. This would allow Australia to capitalise on its opportunity to supply LNG to countries needing to ensure their energy supply, bringing economic benefits and faster revenues.

However, these developments are contingent on a 50-year extension to its current license being given, which would allow production to continue until 2070 (20 years after Australia’s legally binding net-zero target of 2050). Close to 800 objections were filed last year with the Environmental Protection Agency (EPA) of Western Australia after it recommended that the extension be granted.

Last week, Guardian Australia reported that the EPA has dismissed the grounds for appeal, in a move that seems to go against the federal government’s direction. Activists have pointed to Woodside’s own estimate of potential emissions from the project, which puts it as being equivalent to ten years of Australia’s current total carbon emissions.

Climate scientist Peter Newman has argued that going ahead with the licence extension would “dwarf everything else” Australia has been doing to battle climate change. The project still requires federal approval and activists are calling for the environment minister to step in as the extension would see gas exports continue well past Australia’s net-zero commitment year of 2050.

While the supply of LNG in Australia is set to remain steady and demand, although in decline, is projected to stay high, changing public and government opinion puts the market in a precarious position. Reluctance to approve expansions or new projects, over valid environmental concerns, may restrict growth in the sector in the future.

Related Company Profiles

Energy Quest Inc

Lang Kft

LABOR CO LTD

EPA Sp zoo

Woodside Energy Ltd