The banking crisis began after the collapse of the Silicon Valley Bank in March 2023. The snowball engulfed the US banks Silvergate, Signature and First Republic, raising fears of contagion. Rising interest rates have also impacted lending in the world’s largest economy that could have a ripple effect globally.

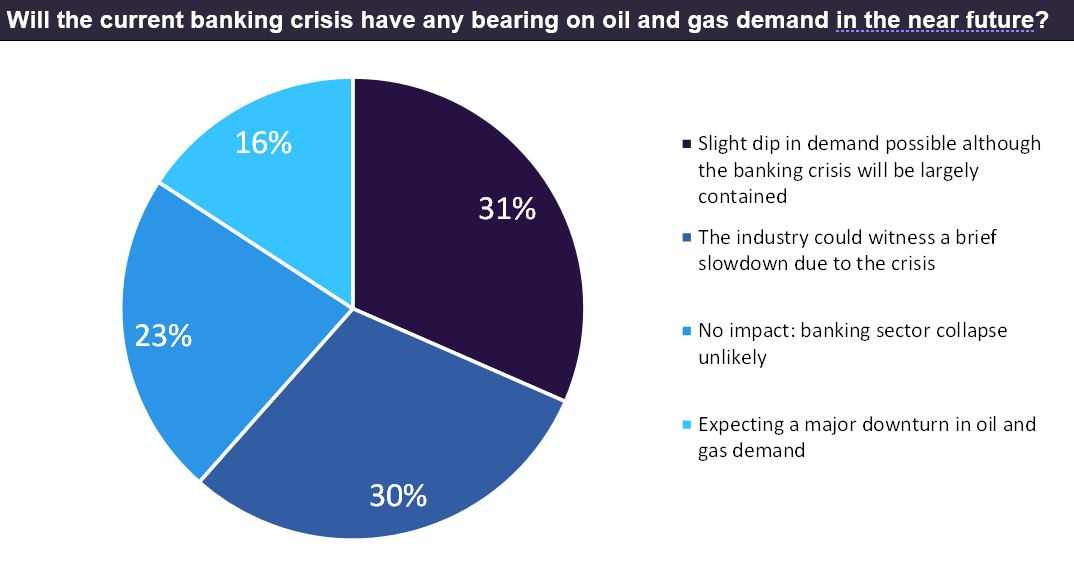

During April and May 2023, GlobalData conducted a poll among industry players inquiring about the potential impact of this banking crisis on the oil and gas industry. The poll numbers showed diverse views among respondents, perhaps due to the uncertainty over the crisis, but indicated that the oil and gas industry would hold its ground in the near future.

Around a third of respondents believed that the banking crisis will be largely contained, although it could result in a slight dip in demand for products from the energy sector. This can be largely attributed to the swift actions taken by the US Federal Reserve, such as the setting-up of the Bank Term Funding Programme aimed at supporting American businesses and households by making additional funding available. The US Federal Deposit Insurance Corporation’s (FDIC’s) deposit insurance limit of $250,000 per account was also relaxed for Silicon Valley Bank and Signature Bank, to protect their customers. Overall, the government intervention has somewhat helped to calm public fears about losing their savings.

Around 30% of respondents felt that the banking crisis could cause a brief slowdown in the oil and gas industry. The statement of the chairman of the US Federal Reserve, following the meeting of the Federal Open Market Committee (FOMC) in June 2023, indicated that rate cuts might not happen for a couple of years due to ongoing high inflation. Although rates were not hiked in June 2023, he indicated further rate hikes before the end of 2023.

This would prevent easy access to loans and could result in a contraction of economic activity, leading to a potential slump in oil and gas demand. This, in turn, could result in a fall in oil prices, potentially compelling companies to adopt production cuts as well as to defer new project developments.

Notably, almost a quarter of the respondents dismissed fears of a banking sector collapse. They deemed that the current banking situation would be quickly contained and would have no effect on demand for oil and gas.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFinally, around one-sixth of the respondents feared a major downturn in oil and gas demand in the near future. Memories of the mishandling of the US banking and financial services sector that resulted in the global economic crisis in 2008 are still fresh in people’s minds. That crisis was an important lesson for workers from multiple sectors, including those in the oil and industry, warning them to be wary of a collapse in the banking sector.

Related Company Profiles

Federal Deposit Insurance Corp

Signature Bank

Silicon Valley Bank

Signature LLC