The oil & gas industry continues to be a hotbed of innovation, with activity driven by improving productivity, minimising downtime, and enhancing safety, and growing importance of technologies such as big data, machine learning and AI. In the last three years alone, there have been over 534,000 patents filed and granted in the oil & gas industry, according to GlobalData’s report on Innovation in Oil & Gas: Aromatic polycarbonates. Buy the report here.

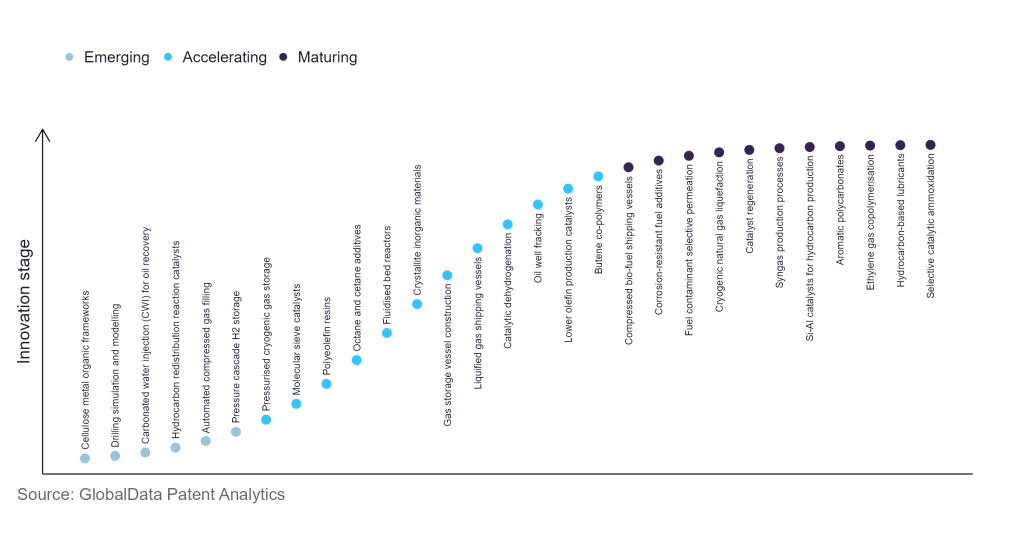

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

40+ innovations will shape the oil & gas industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the oil & gas industry using innovation intensity models built on over 256,000 patents, there are 40+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, drilling simulation and modelling, carbonated water injection (CWI) for oil recovery, and automated compressed gas filling are disruptive technologies that are in the early stages of application and should be tracked closely. Liquified gas shipping vessels and oil well fracking are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are compressed bio-fuel shipping vessels and cryogenic natural gas liquefaction, which are now well established in the industry.

Innovation S-curve for the oil & gas industry

Aromatic polycarbonates is a key innovation area in oil & gas

Polycarbonate in general is a hard and transparent plastic that has high strength and stiffness. Another significant property of polycarbonates is their low-temperature impact resistance. Melt condensation and interfacial polycondensation are the techniques used in the preparation of aromatic polycarbonates.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 30+ companies, spanning technology vendors, established oil & gas companies, and up-and-coming start-ups engaged in the development and application of aromatic polycarbonates.

Key players in aromatic polycarbonates – a disruptive innovation in the oil & gas industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to aromatic polycarbonates

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| LG | 547 | Unlock Company Profile |

| Idemitsu Kosan | 539 | Unlock Company Profile |

| Mitsubishi Gas Chemical | 396 | Unlock Company Profile |

| Saudi Arabian Oil | 388 | Unlock Company Profile |

| Mitsubishi Chemical Group | 321 | Unlock Company Profile |

| Covestro | 273 | Unlock Company Profile |

| Teijin | 112 | Unlock Company Profile |

| Lotte Chemical | 108 | Unlock Company Profile |

| Sumitomo Seika Chemicals | 85 | Unlock Company Profile |

| Danimer Scientific | 31 | Unlock Company Profile |

| Nitto Denko | 28 | Unlock Company Profile |

| Dow | 26 | Unlock Company Profile |

| SK Innovation | 26 | Unlock Company Profile |

| SK | 25 | Unlock Company Profile |

| International Business Machines | 21 | Unlock Company Profile |

| BASF | 19 | Unlock Company Profile |

| KCC | 17 | Unlock Company Profile |

| Mitsubishi Chemical Holdings (MCHC) | 17 | Unlock Company Profile |

| China Petrochemical | 16 | Unlock Company Profile |

| FRX Polymers | 15 | Unlock Company Profile |

| Sumitomo Chemical | 11 | Unlock Company Profile |

| Wanhua Chemical Group | 11 | Unlock Company Profile |

| Honshu Chemical Industry | 10 | Unlock Company Profile |

| Repsol | 10 | Unlock Company Profile |

| DuPont de Nemours | 6 | Unlock Company Profile |

| Samsung SDI | 6 | Unlock Company Profile |

| Centre National de la Recherche Scientifique | 6 | Unlock Company Profile |

| AGC | 6 | Unlock Company Profile |

| Sekisui Kasei | 5 | Unlock Company Profile |

| Shin-Etsu Chemical | 5 | Unlock Company Profile |

| Asahi Kasei | 5 | Unlock Company Profile |

| TotalEnergies | 5 | Unlock Company Profile |

| Xerox Holdings | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Idemitsu Kosan is one of the leading patent filers in the aromatic polycarbonates segment. The company is actively developing and supplying advance polymer designs such as TARFLON PC, an aromatic polycarbonate. It has found a wide range of industrial applications due to its impact resistance, good dimensional precision, high heat resistance and adequate transparency. Other key patent filers in aromatic polycarbonates are LG, Covestro, Mitsubishi Gas Chemical and Sumitomo Seika Chemicals.

In order to increase demand for aromatic polycarbonates over the coming years, companies need to invest on projects that engineer advanced models of aromatic PCs, so that it can find wider and environmentally sustainable applications.

To further understand the key themes and technologies disrupting the oil & gas industry, access GlobalData’s latest thematic research report on Top 20 Oil & Gas Themes 2022.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.