GlobalData’s latest report, ‘Unconventional Production in the US Lower 48, H2-2021’, provides a comprehensive review of hydrocarbon appraisal and development across major shale plays in the United States (US) Lower 48 (L48) region. The report also provides an outlook for oil and gas production in these plays until 2025, along with the competitive positioning of major operators.

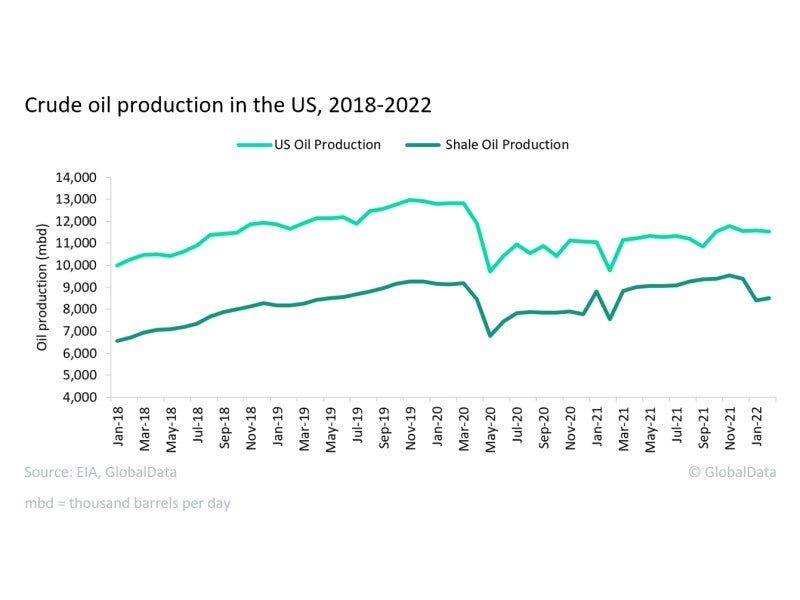

Crude oil production in the US has recovered considerably from the lows seen during the first wave of the Covid-19 pandemic and the brief price war between Saudi Arabia and Russia. The country produced approximately 11,526.9 thousand barrels per day (mbd) of crude oil in February 2022, a 19% gain over the May 2020 production of 9,711.1mbd. Over the same period, US shale oil production has risen by 25% to 8,492.7mbd in February 2022. However, the country’s crude oil production is still around 10% below the levels last seen during the fourth quarter of 2021. Nevertheless, as most countries have eased the Covid-19 restrictions that were in place earlier, the global crude demand is anticipated to rise over the coming months. In line with this growth, US crude oil production is also anticipated to rise further and might reach pre-pandemic levels by 2023.

The industry downturn in 2020 had compelled operators to cut down their capital spending, which also led to a significant drop in the US rig count. Then in 2021, the crude production cuts from OPEC+ producers supported a recovery in global oil prices. This factor, along with a rise in global energy demand following the easing of Covid-19 curbs pushed oil prices further up. Lately, the Russia-Ukraine military conflict has sent oil prices skyrocketing, while the global energy demand is also on an upward trend. West Texas Intermediate (WTI) futures were averaging $91.64 in February 2022. The ongoing war and subsequent sanctions on Russia have pushed WTI futures further up. The Energy Information Administration (EIA) expects WTI futures to average at $113 in March 2022 and might remain in this range if the war continues for a longer duration. The US rig count has also risen nearly 60% in one year, to 574 as of February 2022. Nevertheless, this count is still far less than the 719 rigs that were operational in the country before the Covid-19 outbreak in 2020.

Related Company Profiles

EIA

WTI, LLC