Equinor and its partners plan to invest $7bn-$8.7bn (Nkr60bn-Nkr75bn) for the development of the Wisting field in the Barents Sea, Norway.

Estimated to contain nearly 500 million barrels of oil equivalent, the Wisting field will become the world’s northernmost oilfield when developed.

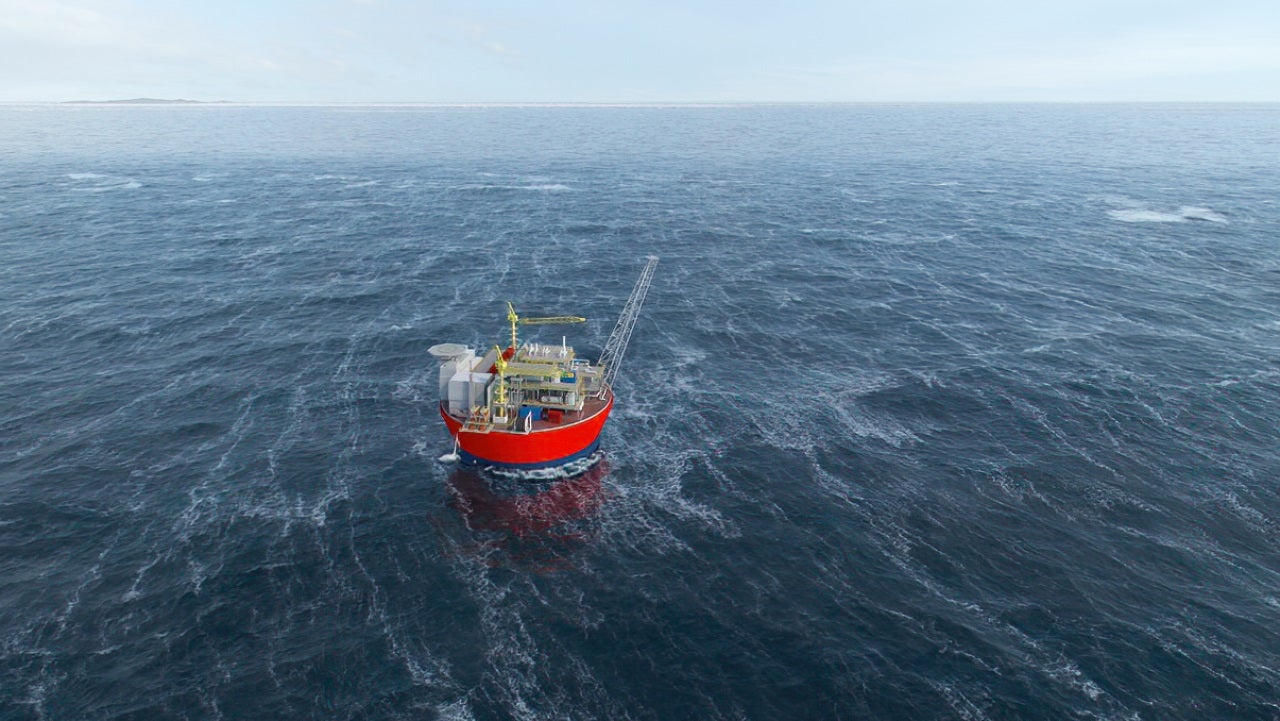

The Wisting development concept includes circular floating production storage and offloading (FPSO) and a power-from-shore solution to reduce carbon dioxide emissions.

The partners plan to submit a plan for development and operations (PDO) for the project by end of the next year with production expected to start in 2028.

Equinor project development senior vice-president Geir Tungesvik said: “A decision to develop the Wisting field will generate considerable value for Norwegian society and spin-offs for Norwegian supplier industry both in the development and operations phases.”

The company has also awarded a front-end engineering and design (FEED) contract for the FPSO to Aker Solutions.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe contract, which is valued at around $40.5m (Nkr350m), also includes an option for engineering, procurement, construction, and installation (EPCI) work which is estimated at $930m-$1.39bn (Nkr8bn-Nkr12bn).

Aker Solutions will be responsible for developing an overall solution, including topside facilities, living quarters and a hull.

The FEED work will be conducted primarily in Norway. Leirvik and Sevan SSP will serve as sub-suppliers of engineering services for the living quarters and hull respectively.

Equinor has a 35% stake in Wisting discovery. Other partners are OMV (25%), Petoro (20%), Idemitsu (10%), and Lundin Energy (10%).

Last month, Equinor reported a net income of $1.41bn in Q3 2021.